It's not over, it has only slipped into the background: the issue of the trade conflict between the USA and the EU. The USA has updated its list of products from the EU which are subject to import duties because of the "aircraft affair" (subsidies of Airbus). Some products are being removed from the list, others are newly added. For example, from 1 September, German and French fruit jams will be subject to customs duties. Even if the changes are marginal and not significant from a macroeconomic point of view and therefore irrelevant for EURUSD, they have a sweet and sour taste. For they show that the EU is still on the negative list of the USA in terms of trade relations even if the USA this time did not increase the tariffs (from currently 15% and 25% to 100%) or significantly extended the list. The US President certainly has enough other problems at the moment that he wants or needs to address first. But just because his focus in the trade dispute is currently on China and Canada does not mean that Europe were safe from coming back into focus. And if it where only for election campaign purposes.

However, it is reckoned that, given the many other domestic and foreign policy issues in the US, the EU will be safe for the moment in this regard until after the presidential elections.

Meanwhile, the currency market is in holiday mode anyway. The large economic figures have been digested and no new impulses are coming from monetary policy, so that it is primarily the covid infection figures and smaller data releases that are attracting attention. So nothing earth-shattering. And the fact that the two parties in the US are likely to agree on a fiscal package in the end is probably already largely priced into the dollar. This suggests that EUR-USD will continue to move sideways to slightly higher ahead of eurozone PMI data announcement that is scheduled for the next week.

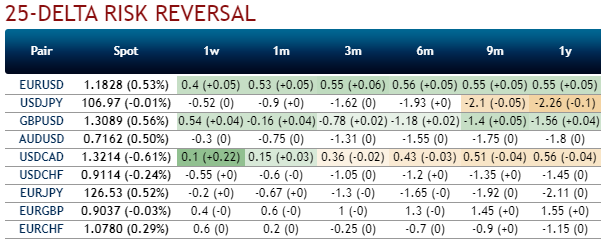

OTC Updates: EURUSD risk reversals are trading positively again, and at almost +0.5 across all tenors (refer 1st chart). Why’s that so, is this because the dollar is less suited as a safe haven or above-stated factors? Perhaps marginally. Above all because the market is considering the risk of a second wave of the pandemic to be low and considers a major, risk-driven slide in EURUSD to be less likely. Otherwise butterflies would not be virtually back at pre-corona levels. That might be sensible pricing levels for all those market participants who can spread their risks. Anyone not able to enjoy that luxury might be pleased about this good opportunity to hedge non-diversified risks against a renewed wave of risk aversion.

EUR risk reversals abating to indicate the hedging sentiments for consolidation phase looks appealing in the long run, as the fresh positive bids are added to the positive RRs across all the tenors (1st chart).

Most importantly, the positively skewed EURUSD IVs of 3m tenors are stretched on either side but with slight biasness towards downside hedging risks (refer 2nd chart), while IVs are edging higher above 7%.

Hence, considering all these factors, the below options strategies are advocated.

Options Strategy: Contemplating above factors, we now advocate 1m 0.51 delta call options on hedging grounds.

Alternatively, with the same objective of arresting upside risks, we recommend long hedges of August tenors as we could foresee further upside risks in the days to come while the pandemic and macroeconomic turmoil remain intact. Courtesy: Sentry, Saxo & Commerzbank

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics