A glimpse on bullion market:

Gold price seems to be the consistent standout under an investor positioning mean reversion rule with a success ratio of over 60% over the last five years and modest average monthly returns, albeit with a low information ratio.

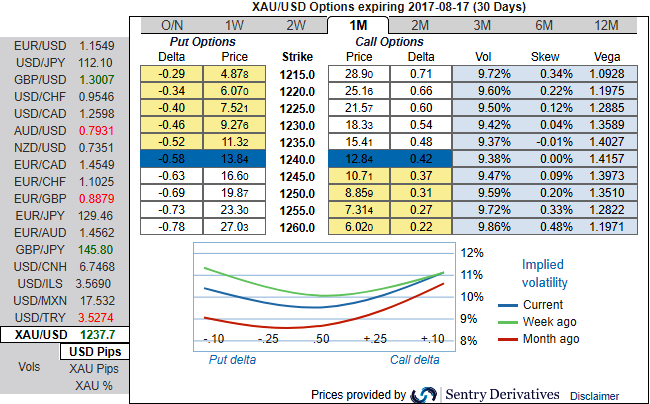

Yellow metal prices kept spiking after testing support 1215.50 levels and now is on the verge of two weeks highs and is on the track to post third straight days of gains as it hits investor demand for the precious metal. Gold futures contracts are at $1,236 a troy ounce by 07:15 GMT after touching its highest since July 3 at $1,238.10 earlier.

OTC outlook and Options Strategy: 3-Way Options straddle versus put

Spread ratio: (Long 1: Long 1: Short 1)

Rationale: The nutshell showing delta risk reversals above explains that hedgers’ interests have been neutral in 1m tenors but downside risks are lingering in 1w tenors. While IVs skews are also well balanced on either side to signal the spot prices may oscillate in either direction.

As a result, we don’t see much traction OTM calls. While 1m IVs trending at 10.34%, while 1w IVs have been shrinking below 8.9%. A seller wants IV to shrink away so the premium falls. You should also note short-dated options are less sensitive to IV, while long-dated is more sensitive.

Contemplating these facts and figures, we encourage vega longs and short thetas in the non-directional trending pair but slightly favors bearish strategy as the Vega signifies the sensitivity of an option’s value owing to a shift in volatility. It is usually expressed as the change in premium value per 1% change in implied volatility.

The execution: Initiate long in XAUUSD 1M at the money Vega put, long 1M at the money Vega call and simultaneously, Short Theta in 1m (1%) out of the money put with positive theta or closer to zero.

Theta is positive; time decay is bad for a buyer, but good for an option writer.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate