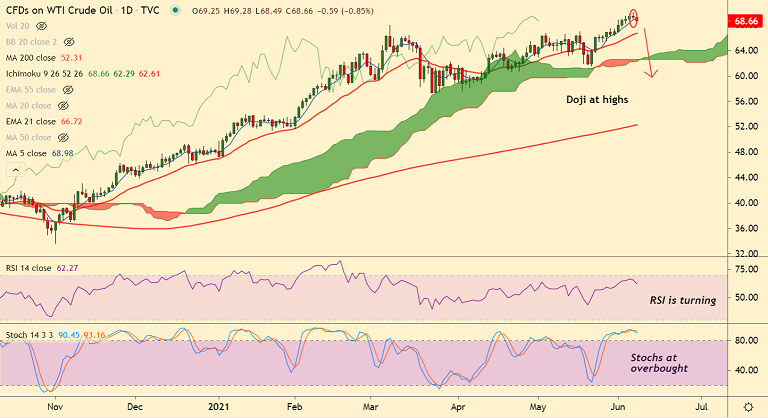

USOIL chart - Trading View

West Texas Intermediate (WTI) crude is extending declines from multi-month highs at $69.97 after doji formation in the previous session.

WTI was trading 0.93% lower on the day at $68.61 at around 12:00 GMT, after closing 0.19% lower in the previous session.

OPEC+ expect oil stockpiles to fall further in the coming months, OPEC's Secretary-General Mohammad Barkindo said in a virtual appearance at the Nigeria International Petroleum Summit.

Barkindo’s upbeat comments failed to lend support to oil prices which were dragged down amid dollar gains.

WTI was rejected shy of $70 mark, remains pressured below $69, scope for further downside.

Weakening demand from Asia as Covid-19 resurgence in most of the South Asian countries depresses fuel demand in the continent dent prices.

Technical indicators are bullish. However, the pair finds major resistance at 200-month MA at 69.89.

Doji formation on the daily charts suggests indecision among bulls to take prices higher. Bears eyes immediate support at 200H MA at 67.95.

On the flipside, decisive break above 200-month MA required for upside continuation.

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk