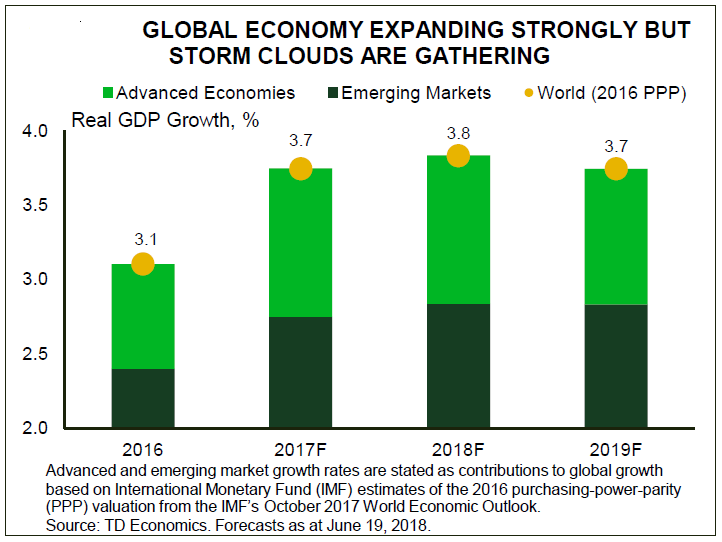

Global growth is expected to run at a robust 3.8 percent this year, similar to last year. However, this steady performance hides a weaker-than-expected start in the Euro Area and the UK, which can be partly chalked up to temporary factors, according to a recent research report from TD Economics.

Fortunately, a recovery from the first quarter stumble appears underway, with both regions expected to benefit from moderately above-trend growth over the next couple of years. It’s already becoming clear that the real standout performer for 2018 is going to be the U.S., which is tracking a 3.0 percent pace. The U.S. is widening its lead on other G7 economies this year, leading to less synchronous growth among the major economies relative to 2017.

Price pressures have also been building unevenly, with core inflation measures already near the central bank targets for the U.S. and Canada. In contrast, underlying wage and price pressures in Europe, the UK, and Japan remain relatively subdued, providing little incentive for a knee-jerk removal of past emergency stimulus.

Further the U.S. dollar rally in the past few months is a reflection of this divergence theme. This may become more difficult to sustain among the G7 currencies, as second quarter economic data offers investors more confidence. However, emerging markets remain vulnerable, as U.S. assets will remain more attractive from a risk-reward standpoint, the report added.

Within Europe, much of the slowdown earlier this year can be chalked up to weakness in France and the UK. Over the next two years, an average projection of about 2 percent for real GDP happens to land right in between last year’s solid 2.6 percent advance and the Euro Area’s long-run trend rate of about 1.3 percent.

"This means economic slack will continue to diminish, even if it’s at a slower pace than previously expected. This is why the central bank has gained confidence in telegraphing plans to commence a long-awaited tapering of its asset purchase program this year," the report commented.

At this point, G7 central banks are choosing to look-through the near-term challenges to the outlook for growth and inflation. As a result, we anticipate that the Federal Reserve is on track to push its policy rate higher in September, and Canada is likely to proceed with raising rates in July, a final time for 2018. Overseas, the Bank of England has become more patient, as unexpected economic weakness and gradually falling inflation has stayed its hand at least until this August.

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment