Hungary’s central bank left its benchmark interest rate at a record low of 0.9 percent for a fifth month in October and signaled that the easing cycle is finished for now. The central bank, which targets 3 percent price growth in the medium term, said at its October meeting that it still saw the inflation environment as “subdued.”

Hungary's inflation rose more-than-expected to hit a 3-year high in October, data released by the Hungarian Central Statistical Office showed on Tuesday. Inflation rose to 1 percent in October from 0.6 percent in September, beating forecasts for a rise of 0.8 percent. This was the highest since September 2013, when prices advanced 1.4 percent. MNB in October lowered its inflation projections for 2016, but forecasts core inflation to accelerate to 2.9 percent in 2017.

"In our view, however, CEE core inflation does not show any real sign of turning around. All signs of acceleration are limited to the influence of energy price base effect on year-on-year rates of change. Mild acceleration in such year-on-year rates is unlikely to lead to sustainable inflation acceleration back to target," notes Commerzbank in a report.

Moody's upgraded Hungary's debt into investment grade late on Friday. Fitch did this first in May, S&P surprisingly upgraded in September. The forint has firmed in the past months due to Hungary's improving economic fundamentals and ratings upgrades. Money managers will likely be increasing their portfolio exposure to Hungarian assets, which would be further HUF-supportive in the near-term.

Hungarian central bank (NHB) Governor Gyorgy Matolcsy told in an interview today that the central bank could keep its main base rate at 0.9 percent in the long term even if major central banks start hiking interest rates. Matolcsy said the bank, which has provided cheap funding was not planning a similar loan programme in the second half of his six-year term. Separately, the bank said on its website that underlying indicators still pointed to low inflation pressures.

"We have set ourselves for a base rate level which can work in the long term, which can be maintained even if the Fed carries out a new rate hike cycle in several steps and if potentially the ECB and the Japanese central bank respond to that," Matolcsy said.

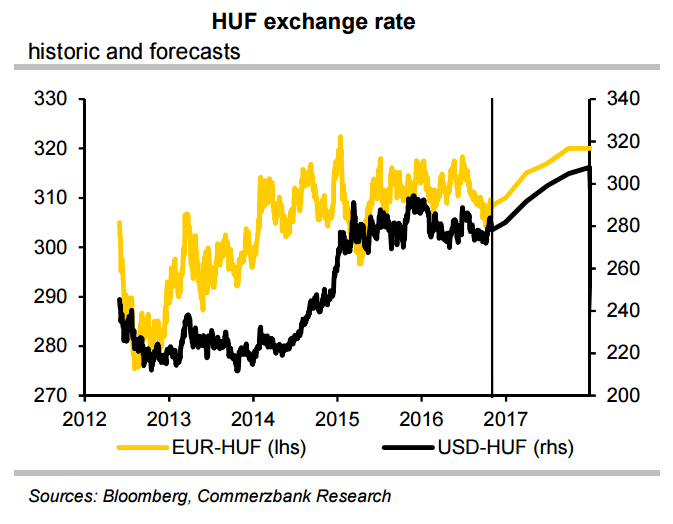

EUR/HUF edged lower from day's highs around 306.25 to trade at 305.70 at around 12:15 GMT. Intraday bias for the pair remained lower. 5-DMA at 306.46 was immediate resistance on the upside, while downside finds little support till 303.32 (Oct 7 lows).

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves