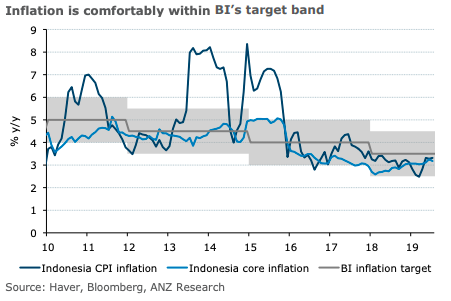

Indonesia’s inflation is likely to stay comfortably within the central bank’s 2.5-4.5 percent target band despite the higher than anticipated July print, according to the latest report from ANZ Research.

The country’s both headline and core CPI inflation beat consensus expectations. Headline CPI inflation edged up to 3.32 percent y/y in July, while core inflation softened less than expected to 3.18 percent y/y. An increase in the price of administered items offset softening core and flat volatile food inflation.

Four categories including foodstuffs, housing and utilities, prepared food and health which cumulatively account for around 65 percent of headline CPI recorded easing annual inflation. However, this was offset by increases in the clothing and transport components.

Notably, transport prices picked up to 2.2 percent y/y in July from 1.9 percent in June. In sequential terms, headline CPI rose by 0.31 percent m/m in July, lower than the 0.55 percent m/m increase in the prior month. The pace of increase eased in all components except for education.

Core CPI, which excludes volatile food and government-controlled prices, rose by 0.33 percent m/m in July, marginally lower than the 0.38 percent increase recorded in June. In y/y terms, core inflation eased to 3.18 percent y/y, from 3.25 percent in the previous month.

"The big picture is that inflation remains under control and comfortably within the central bank’s 2.5-4.5 percent target band. We continue to see scope for the policy rate to be lowered by 50bps over the coming quarters," the report further commented.

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns