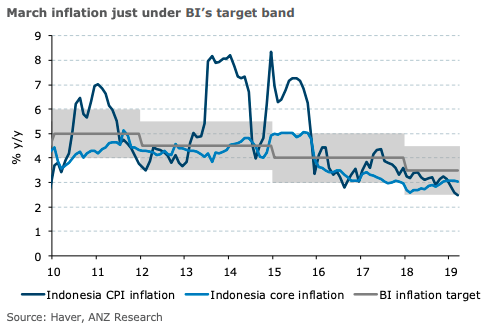

Indonesia’s headline inflation eased for a fourth straight month in March, and at 2.48 percent y/y, is just below Bank Indonesia’s (BI) 2.50-4.50 percent target band. Most major components saw a slight pullback, with housing the key exception. Core inflation also edged down.

The slowdown in headline inflation in March was largely broad-based and partly reflect higher base effects. Housing prices was the only major category that saw a faster pace of increase in y/y terms.

In sequential terms, headline CPI rose 0.11 percent m/m, reversing the 0.08 percent fall in February. The increase mainly reflected a faster pace of increase in transport prices and a slower decline in food prices. The m/m increase in core CPI slowed to 0.16 percent m/m (from 0.26 percent), which translated to a 3.03 percent y/y rise in March.

Softening inflation on its own is unlikely to trigger imminent policy easing by BI, given that its main focus remains on external resiliency.

Given BI’s focus on external stability, however, policymakers are unlikely to react to the softening inflation numbers with imminent policy easing, the report added.

"Our base case is for BI to maintain a wait-and-see stance in 2019 and rely on other accommodative macroprudential measures to support economic activity instead. Should we see a sustained improvement in the trade balance, coupled with rupiah stability, we will reassess our forecast," ANZ Research further commented.

Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens

Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal