Malaysia’s economic growth for the fourth quarter of this year is expected to come in at 4.2 percent y/y, while the full-year expansion is seen at 4.6 percent y/y, according to the latest research report from OCBC Bank.

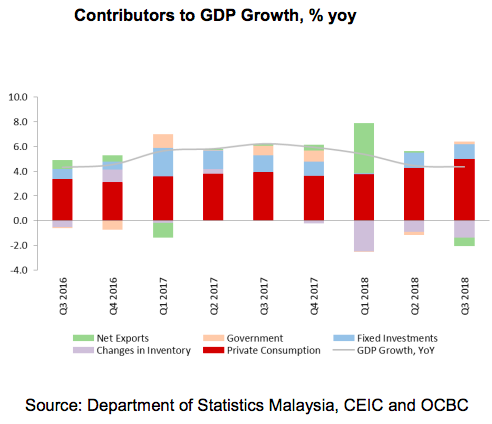

GDP growth slowed further for Q3 2018 at 4.4 percent y/y, vs 4.5 percent y/y in the Q2 as the mining and quarrying sector continued to struggle whilst private consumption surged. The growth this quarter is the slowest it has been since the Q3 2016 when the economy grew at 4.3 percent y/y.

Private consumption as usual was the biggest contributor to growth followed on by fixed investment. Government consumption expanded positively this time around but net exports saw a decline.

There were still weaknesses in the commodities sector for the quarter. The mining and quarrying sector continuing to struggle as it further declined by 4.6 percent y/y, vs Q2 at -2.2 percent y/y. Production of crude oil & condensate and natural gas continued. The agricultural sector also saw a decline of 1.4 percent y/y but this decrease was lower than the prior quarter at -2.5 percent y/y.

However, the palm oil sector continued to see weaknesses. The central bank had already earlier warned in their November monetary policy statement of “prolonged weakness in the mining and agriculture sectors”.

Net exports declined this quarter by 7.5 percent y/y (Q2 2018: 1.7 percent y/y) as exports declined by 0.8 percent y/y (Q2 2018: 2.0 percent y/y). This occurred as commodities exports continued to see a contraction albeit smaller at 3.0 percent y/y (Q2 2018: -3.8 percent y/y). Crude palm oil exports continued to decline whist growth in exports of mineral resources, particularly in crude petroleum improved.

However, non E&E exports particularly in petroleum products did moderate. Further, the silver lining for the quarter is that growth of gross fixed capital formation actually accelerated to 3.2 percent y/y (Q2 2018: 2.2 percent y/y).

Furthermore, this growth was driven by private sector investment which continued to grow strongly at 6.9 percent y/y whilst public sector investment continued to decline by 5.5 percent y/y.

"For the final quarter, we are now expecting growth to moderate to 4.2 percent y/y which means we forecast the entire year growth to come out at 4.6 percent y/y. The main driver of this slowdown would obviously be that we foresee private consumption growth slowing down significantly as the tax holiday comes to an end and consumers had frontloaded expenditure in the previous quarter. Exports will probably see some recovery although not significantly whilst investment growth should still continue to exhibit some strength," the bank commented.

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility