Malaysia’s economic fundamentals are stronger on multiple fronts today compared to the previous election, despite a politically charged climate and this could, very well, work in the ruling party’s favor, according to a recent research report from DBS Bank.

Malaysia is headed for a hotly contested general election on 9 May. The incumbent government, led by Prime Minister Najib Razak, will be challenged by the opposition coalition led by former Prime Minister Dr. Mahathir Mohamad.

In the previous election in 2013, PM Najib’s coalition won 133 out of a total of 222 parliamentary seats but secured only 47.38 percent of the popular vote. In recent years, issues such as the 1MDB scandal, as well as the introduction of an unpopular Goods and Services Tax (GST), have complicated matters for the incumbent government.

The generosity in the last fiscal budget also added some short-term support for private consumption. Total budget allocation increased by 7.5 percent to MYR280.25 billion for FY18, up from MYR260.8 billion previously. Subsidies and the social assistance scheme, which accounts for 11.3 percent of total operating expenditure, is projected to rise by 15 percent after two consecutive years of declines.

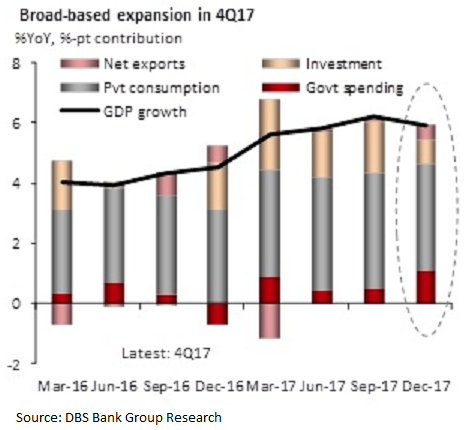

"GDP growth registered 5.9 percent in 2017, up from the commodity-/oil-driven slump in the preceding two years and significantly stronger than the 4.7 percent in 2013. While expected to be a tad slower at 5.0-5.5 percent, this year’s growth will be more broad-based and led mainly by robust domestic growth," the report added.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens

Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality