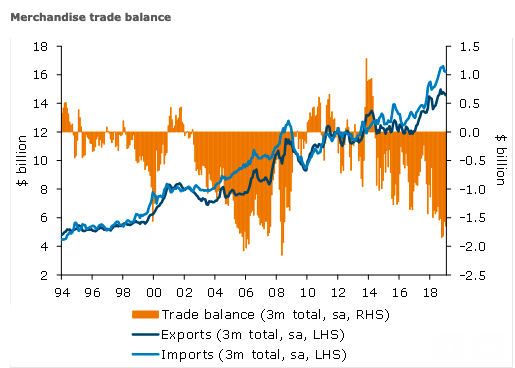

New Zealand’s trade balance for the month of January came in considerably weaker than market expectations with exports below expectations and imports considerably stronger. Exports are expected to pick up in the coming months as more meat and dairy products start to flow out of the country, according to the latest report from ANZ Research.

The unadjusted monthly trade balance turned a large deficit of $914 million in January. Exports at just $4.4 billion were below expectations with the slow start to the meat processing season primarily to blame. Imports were strong, partially due to a $200 million large item, but the overall import strength indicates domestic demand remains robust.

On a seasonally adjusted basis, exports decreased 7.8 percent m/m. Dairy volumes lifted, but the recent uptick in dairy prices is yet to be reflected in export values. Meat volumes were down 6.2 percent which combined with slightly weaker prices pulled the value of this export category down 8.8 percent. Strong prices for logs offset a sharp reduction January export volumes which were down 25.3 percent.

Seasonally adjusted imports rose 0.4 percent m/m. Petrol imports dropped by 6.1 percent following a strong lift the previous month. Textiles imports lifted 29.3 percent, more than offsetting the sharp drop in December. Imports of optical and medical goods lifted sharply, up 16.7 percent m/m in January. There was also a large item ($200 million) boosting an already robust print for monthly imports.

On a regional basis, exports to China maintained their positive trend, up 15.2 percent in the year to January. However a sharp drop in exports to Australia was recorded in January, although on an annual basis exports to this market are still slightly stronger.

"The annual deficit is expected to narrow as the year progresses reflecting stronger export volumes of meat, dairy and forestry, while the improvement in prices for dairy should start to flow through in the coming months," the report added.

Image courtesy: ANZ Research

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom