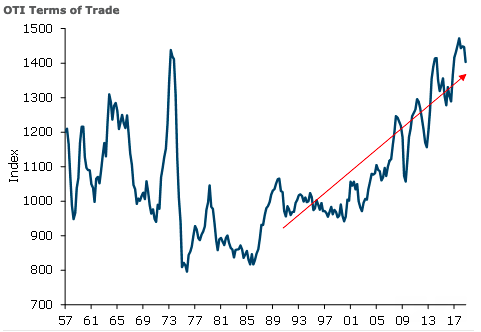

New Zealand’s goods terms of trade fell 3.0 percent q/q in Q4, as import prices lifted while export prices fell. Seasonally adjusted trade volumes lifted with exports up 0.8 percent q/q while imports rose 0.2 percent q/q. This suggests net exports will make a small positive contribution to real expenditure GDP growth in Q4, according to the latest report from ANZ Research.

The OTI goods terms of trade fell 3.0 percent q/q in Q4, due to a 1.4 percent lift in import prices combined with a 1.7 percent fall in export prices. In the December quarter dairy product prices were down 5.7 percent q/q, while meat prices were marginally lower. Higher prices for forestry products provided some offset.

On the imports side the price of petrol was the main culprit for the quarterly rise (+7.5 percent q/q), while the price of imported food also lifted (+1.3 percent q/q). The fall in global oil prices in late 2018 was not reflected in the price of petrol imports. Global oil prices have trended up again in recent months indicating any relief yet to come though the trade data may be short lived.

The volume of petroleum and related products imported in Q4 was 15.1 percent down q/q, but volumes will likely increase in Q1 as the data is impacted by lumpy ship arrival dates.

The volume of dairy and meat products exported in Q4 were both down on a seasonally adjusted basis. The lift in milk production earlier in the season did not hit Q4 indicating a bigger surge can be expected in Q1. Meat export volumes were down 3.8 percent q/q, with the number of lambs slaughtered in Q4 10 percent down on the same time the previous year.

The delay in the lamb kill, means stocks are being grown out to heavier weights and therefore will have a bigger impact on export returns once these start to flow through. Larger volumes of both lamb and beef is only just starting to be shipped now.

"Looking forward, improvements in export volumes, primarily in the meat sector and to a lesser extent the dairy sector, along with improved dairy prices is expected to make a positive contribution to GDP in Q1," the report added.

Image Courtesy: ANZ Research

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out