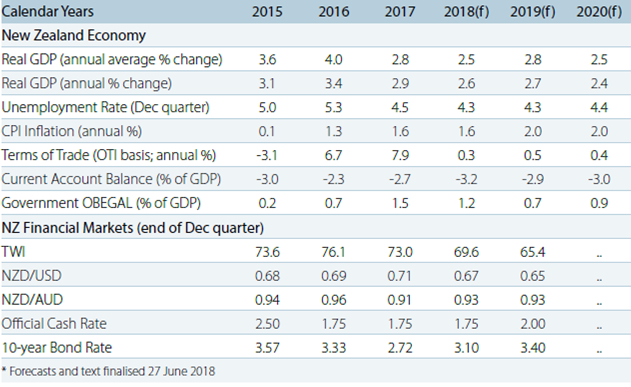

New Zealand’s risks to the domestic inflation profile are skewed to the downside, which could see the Reserve Bank of New Zealand’s (RBNZ) hiking cycle pushed even later. The central bank’s Overnight Cash Rate (OCR) is expected to follow the price direction, according to the latest report from ANZ Research.

This economic cycle has been characterised by strong rates of GDP growth yet stubbornly low inflation. But the economic landscape is expected to be shifting. The economy is going through a softer patch and we expect it will struggle to grow above trend from here.

"On the other hand, cost pressures are increasing and look set to push inflation higher, though likely in a gradual fashion. On balance, and all else equal, we expect inflation will increase and that the OCR will eventually rise: we are pencilling in a hike for November 2019," the report added.

Chinese demand for New Zealand exports continues to hold up, but growth is expected to slow. The ECB remains cautious, but has signalled the unwinding of QE. The Australian housing market is navigating some headwinds and this will likely dampen domestic demand. But other drivers are expected to keep the economy ticking along.

An inactive and cautious RBNZ, together with rising global yields should lead to domestic curve steepening, and a less favourable backdrop for borrowers overall, but it won’t be a smooth ride. The NZD is on the back foot, and further weakness is expected as the implications of a turn in the global liquidity cycle continue to play out. The NZD/AUD remains in a broad range-trading environment.

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk