Today Reserve Bank of New Zealand (RBNZ) will announce after meeting monetary policy decisions at 20:00 GMT.

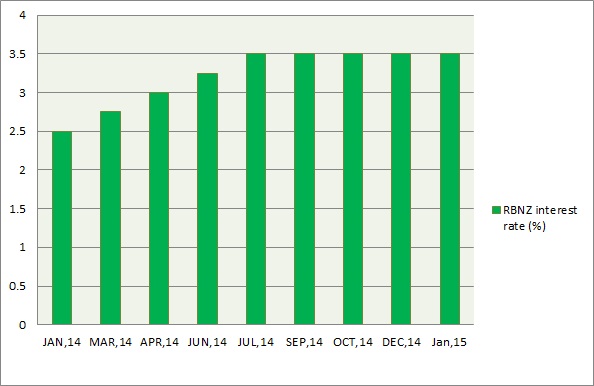

Rate path is explained in chart.

Economic condition -

- New Zealand's economy overall remained robust throughout past years however as of recent facing headwinds due to slow down in China and Europe, two of its major importer.

- Moreover weaker commodity prices and subdued domestic growth notably in housing sectors are to pose challenge for policy participants.

- New Zealand GDP remained robust growing above 3 percent. Unemployment still low at 5.7% but grew from recent 5.4%.

- Debt level is sustainable at close to 35% of GDP.

- However inflation remained subdued and grew only by 0.80% after averaging above 1.5% last year.

RBNZ stance -

- RBNZ has kept interest rates steady at 3.50% since July, highest among developed world.

- Last year it increased rates consecutive four times by 25 basis points till July 2014.

- Contrary to the rate action RBNZ shouted the kiwi down and expects it to reach around 0.65 against dollar. Currently the pair is trading at 0.723.

Expectation and impact -

- Probability of a rate hike is diminished due to lower inflation.

- Kiwi might see appreciation should RBNZ hold interest rate, especially against weaker pairs but limited against dollar.

- Probabilities are high for a rate cut other central banks sought to ease policy except the FED and a slowdown in economic activity. Kiwi's fall would be massive in such a case.

- Kiwi is trading near support of 0.72 against dollar and today's decision could be a make or break event.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate