Explosive Growth in April 2025

Solana saw an uptick in user activity in April 2025, with a 12% month-to-month increase in daily transactions, processing more than 99 million transactions. The increased activity saw a 35% spike in network fees and a 26% increase in revenue. As a result, SOL's price rose by 16% in the last month, to $135.27 as of April 30, with a $1.8 billion 24-hour trading volume.

Drivers of Expansion: DEXs, Memecoins, and Institutional Interest

This expansion was driven by the prevalence of decentralized exchanges (DEXs) such as Jupiter, Meteora, and Raydium, under which retail demand gathered for memecoins like TRUMP and PENGU. Solana tokens also topped the "Alpha" list, gaining trader attention prior to fresh incentive guidelines. In addition, network upgrades such as the Firedancer validator and enhancements to the consensus algorithm, combined with growing institutional adoption in payments and decentralized finance, are setting Solana up for continued growth through late 2025

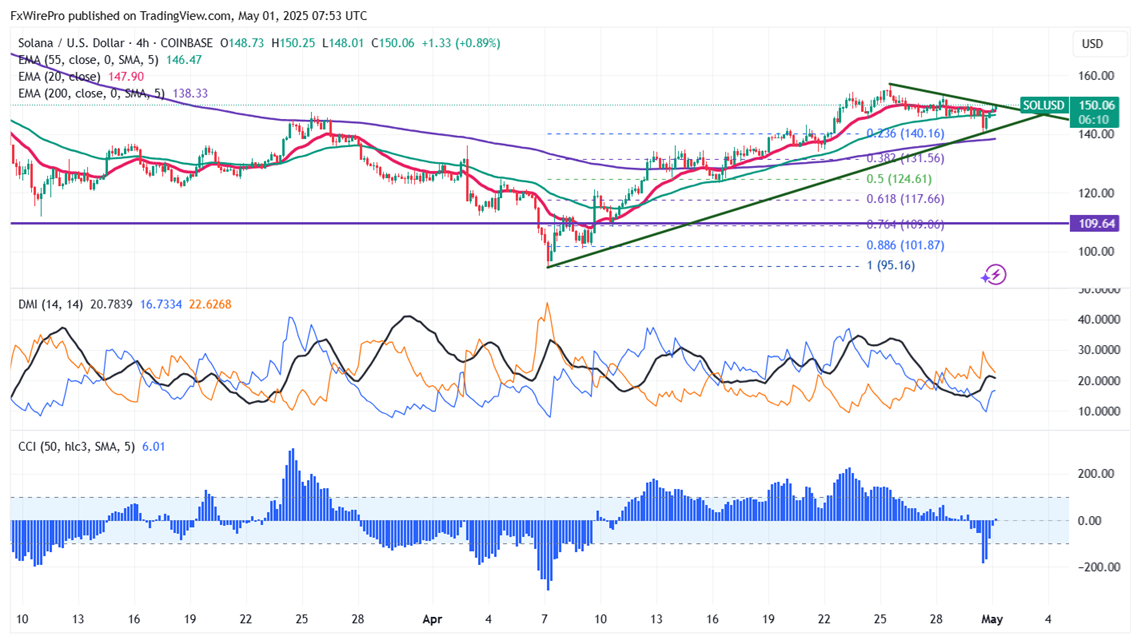

Market Movements: Navigating the Price Trends of SOL

The SOL/USD pair gained more than 70% from minor bottom $95.16. Near-term support is identified at $137, with a drop below this level potentially leading to targets of $123/$117/$100. Immediate resistance is noted at around $160, where a breach could push prices up to $200/$225/$265, or even $300. It is good to buy on dips around $140, with a stop-loss set at $123 and a target price of $300.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate