Thailand’s Q2 2017 GDP data surprised to the upside, coming in at 3.7 percent y/y. Export growth was pretty strong at 6.0 percent, as exports of services rose 8.8 percent. Both agriculture and tourism-related hotels and/or restaurants posted robust 15.8 and 7.5 percent respectively.

Manufacturing continued to struggle, growing at a mere 1.0 percent in the period. For starters, that manufacturing continued to underperform is still a major concern. The 1 percent manufacturing GDP growth in Q2 this year is hardly surprising. Even with exports chalking 6 percent growth in Q2 2017, note that industrial production was practically flat in the period.

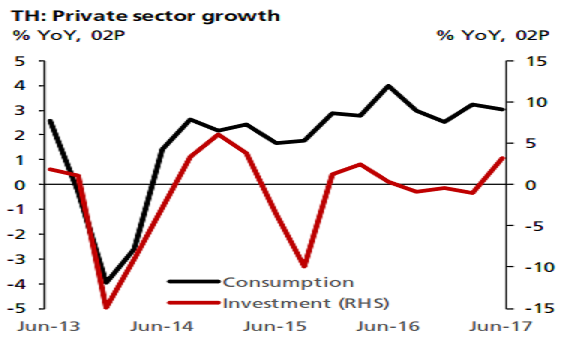

Plenty of excess capacity exists in the sector, which makes up close to 30 percent of the economy. Plainly, without stronger manufacturing sector growth, GDP growth is set to remain below potential. Additionally, overall investment and private consumption growth have actually eased in Q2 2017. Investment (GFCF) growth came in at 0.4 percent y/y in Q2 (1.7 percent in Q1 2017), which is the slowest pace of expansion since mid-2014 barring the temporary blip in 3Q15.

That private investment growth came in at 3.2 percent in the period is mostly due to the low base effects from last year. The normalization in public investment growth means that it is unlikely to be a strong driver of overall GDP growth going forward. Following the Q2 GDP report, the government has revised up its 2017 GDP growth estimate from 3.3-3.8 percent to 3.5-4.0 percent.

"Nonetheless, we reckon that the upward risks to our projections have not changed significantly following the Q2 2017 data release. Much will depend on how strong export growth fares in 2H17. A close monitoring of the trade data ahead is crucial, starting with July numbers this week," DBS Bank commented in its latest research report.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out