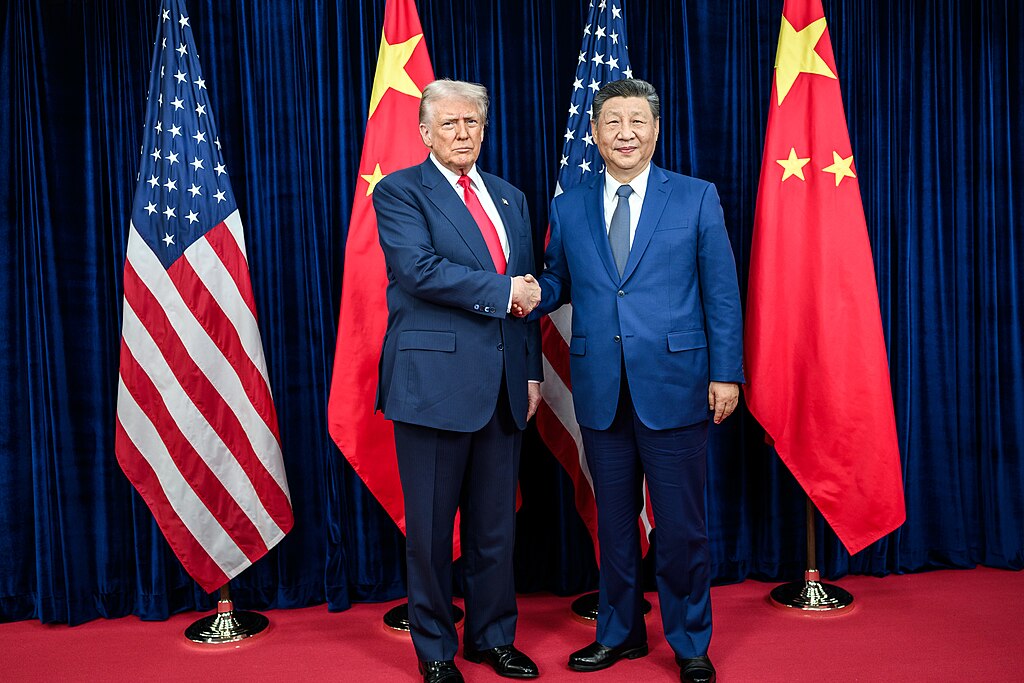

The White House has released details of a new trade agreement between U.S. President Donald Trump and Chinese President Xi Jinping, marking a major step toward easing the ongoing U.S.-China trade war. The deal, finalized in Busan, South Korea, includes tariff reductions, the suspension of Chinese export controls on rare earth minerals, and renewed agricultural purchases, extending a fragile trade truce for about a year.

Under the agreement, the U.S. will halve its 20% tariff on Chinese goods related to fentanyl precursor chemicals, lowering it to 10%. This move reduces the overall tariff rate on Chinese imports to approximately 47% from 57%. In exchange, China will pause its newly announced restrictions on exports of rare earth minerals, gallium, germanium, antimony, and graphite—critical materials for industries like defense, automotive, and technology.

Beijing will also suspend all retaliatory tariffs imposed since March, including those targeting key U.S. agricultural exports such as soybeans, corn, pork, and dairy products. Additionally, China agreed to lift non-tariff measures affecting American companies and terminate antitrust and anti-dumping investigations into U.S. semiconductor firms.

The U.S. will pause new export controls on Chinese technology companies and delay new port fees for Chinese-built and -flagged vessels for one year, helping stabilize global shipping routes.

A major component of the deal includes China’s commitment to purchase at least 12 million metric tons of U.S. soybeans by the end of 2025 and 25 million tons annually for the next three years, restoring trade flows that had been disrupted since 2024.

Both nations also pledged to cooperate on curbing the illegal fentanyl trade, with China agreeing to tighten controls on precursor chemicals. The agreement signals renewed diplomatic engagement between the world’s two largest economies and a pause in years of escalating trade tensions.

Trump Says “Very Good Talks” Underway on Russia-Ukraine War as Peace Efforts Continue

Trump Says “Very Good Talks” Underway on Russia-Ukraine War as Peace Efforts Continue  Trump Congratulates Japan’s First Female Prime Minister Sanae Takaichi After Historic Election Victory

Trump Congratulates Japan’s First Female Prime Minister Sanae Takaichi After Historic Election Victory  U.S. Lawmakers to Review Unredacted Jeffrey Epstein DOJ Files Starting Monday

U.S. Lawmakers to Review Unredacted Jeffrey Epstein DOJ Files Starting Monday  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Trump Allows Commercial Fishing in Protected New England Waters

Trump Allows Commercial Fishing in Protected New England Waters  Japan Election 2026: Sanae Takaichi Poised for Landslide Win Despite Record Snowfall

Japan Election 2026: Sanae Takaichi Poised for Landslide Win Despite Record Snowfall  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  New York Legalizes Medical Aid in Dying for Terminally Ill Patients

New York Legalizes Medical Aid in Dying for Terminally Ill Patients  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Sydney Braces for Pro-Palestine Protests During Israeli President Isaac Herzog’s Visit

Sydney Braces for Pro-Palestine Protests During Israeli President Isaac Herzog’s Visit  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  Netanyahu to Meet Trump in Washington as Iran Nuclear Talks Intensify

Netanyahu to Meet Trump in Washington as Iran Nuclear Talks Intensify  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock