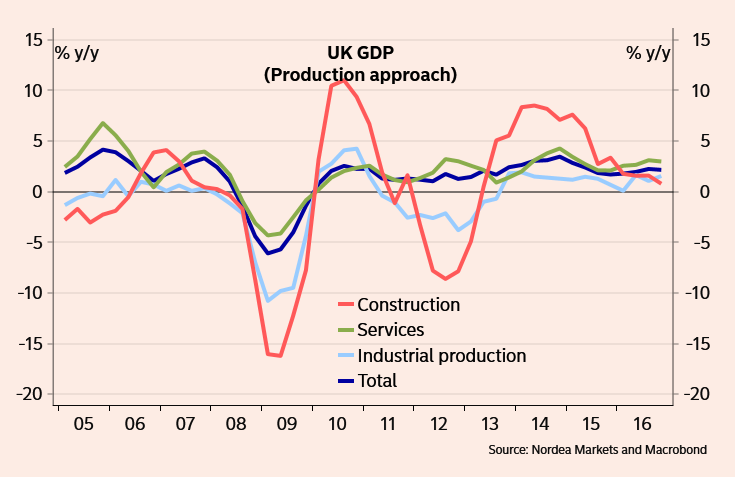

UK growth figures for Q4 confirm resilience of UK economy. Data released by the Office for National Statistics (ONS), showed preliminary estimate of UK Q4 GDP rose 0.6 percent q/q, the same growth rate as in the two previous quarters and above the 0.5 percent consensus forecast.

GDP growth was above the Bank of England’s estimate of a 0.4 percent rise in its November Inflation Report. Q4 reading taken in conjunction with Q3’s gain suggests UK economy grew faster in the six months following the Brexit vote than it did in the six months preceding the vote. Annualised GDP reads at 2.2 percent confirming the UK as one of the fastest-growing major economies in the world.

However, analysts warn weaker sterling and higher inflation will weigh on UK's economy and Britain is headed for a sharp slowdown in 2017. UK inflation is already at 2 1/2 year highs and expected to rise further. Rising inflation is likely to dampen consumer spending which has been the main momentum behind the UK’s continued growth. The Bank of England expects the weak pound to continue to raise import costs and for some of that to be passed on to consumers, squeezing their spending power.

“Looking forward, we do anticipate a slowdown in economic growth, principally because we see the post-referendum fall in the pound pushing up on import prices, in turn raising the CPI inflation rate to more than 3% later this year. That will squeeze household spending power.” said Chris Hare, economist at the bank Investec.

Britain could face a tougher time in the long-term amid “tough and prolonged” Brexit negotiations with the European Union. Last week’s speech by Prime Minister Theresa May only made it clearer that a hard Brexit is on the cards. The UK finance minister Hammond expressing his take on the Q4 GDP report said that GDP figures show fundamental strength and resilience of economy. Some uncertainty could lie ahead as the country adjusts to its new relationship with its European counterparts, Hammond added.

"The solid activity data support our view that the Bank of England will keep monetary policy on hold. Given our forecast of a slowdown in growth during 2017 we continue to expect the bank to look through an expected rise in inflation to well above the 2% target as the effect of the GDP feeds more through to consumer prices." said Nordea Bank in a report.

GBP/USD was trading at 1.2589, down 0.32 percent on the day, while EUR/GBP was at 0.8525 up 0.20 percent. FxWirePro's Hourly GBP Spot Index was at 46.799 (Neutral) at 1200 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal