UK consumer credit increased by the highest amount since 2005 in the month on November, says the Bank of England (BoE)on Wednesday. Data released by the BoE showed UK consumer credit in November alone jumped by 1.926 billion pounds, well above forecasts in a Reuters poll. The rise pushed the annual growth rate in borrowing to 10.8 percent, a rate not seen since October 2005.

Total lending to individuals increased by GBP 5.1 billion in November. Within total lending, secured lending increased by GBP 3.2 billion or 0.2 percent in November. The monetary aggregate M4 rose 0.4 percent from prior month, taking the annual growth to 6.4 percent in November. M4 money supply rise in November fell compared to 1.10 percent in the previous month. Reduced M4 along with increased consumer credit will be looked at with caution.

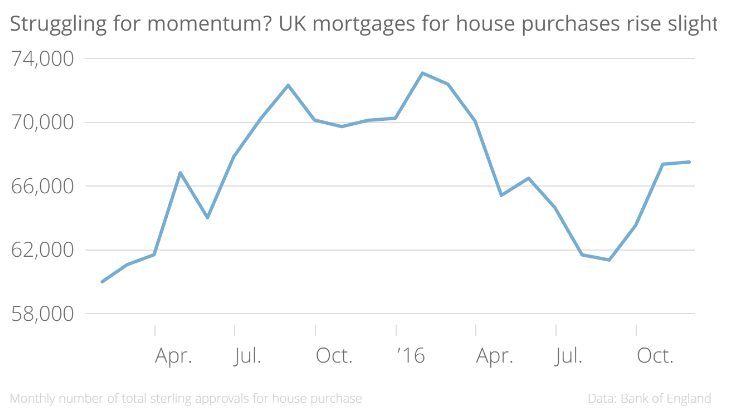

In seperate date, BoE also reported U.K. mortgage approvals data for the month of November which showed U.K. mortgage approvals increased to an eight-month high, highest since March 2016. Data showed number of mortgage approvals in U.K rose to 67,505 in November from a slightly downwardly revised 67,371 in the previous month. The number fell short of market expectations which stood at a level of 68,500.

Net mortgage lending, which lags approvals, rose 3.157 billion pounds in November, the BoE said, somewhat less than a forecast of 3.5 billion pounds in the Reuters poll. BoE had said last month that some households were highly indebted and might struggle as unemployment rose, and separate national accounts data showed British households saved the lowest portion of their incomes since 2008 during the three months after the Brexit vote.

"The overall impression coming from latest data and surveys is that while housing market activity has come off its August lows, but is still relatively limited and struggling to build momentum," said IHS Global Insight Economist Howard Archer.

The BoE forecast in November that mortgage approvals would slow to a monthly average of 65,000 over the next six months. Major lenders also expect weaker house price growth. Economists polled by Reuters expect U.K. economic growth to more than halve this year to a rate of 1.1 percent as inflation rises to close to 3 percent from less than 1 percent in 2016 due to the effect of sterling's sharp fall since June's Brexit vote.

GBPUSD got a lift from better construction PMI, edged higher to hit session highs of 1.2287. But the pair struggled to hold gains, slipped lower to trade at 1.2260 at the time of writing. FxWirePro's Hourly GBP Spot Index was at 56.6118 (Neutral) at 1210 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence