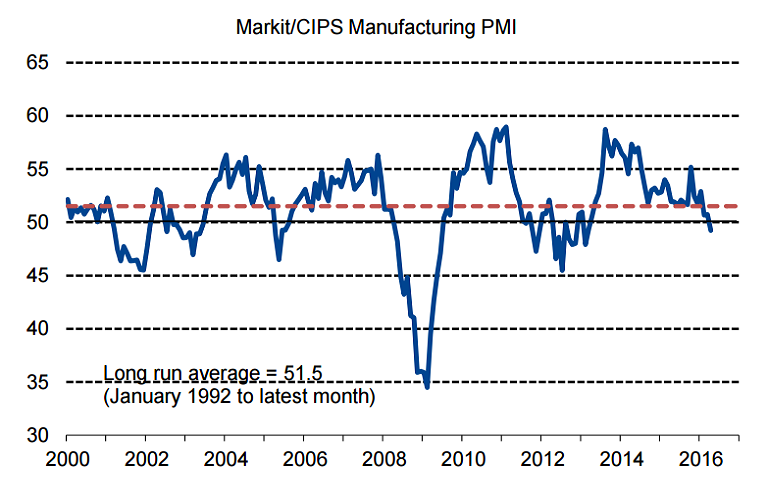

According to the latest purchasing managers' index (PMI) data released by Markit this morning, UK manufacturing PMI index was significantly weaker than expected with a decline to 49.2 for April from a revised 50.7 previously. The data was below the lowest market expectation and contrary to an expected small monthly improvement. The index fell below the critical no-change mark of 50.0 for the first time since March 2013 and raised fears about a sustained slowdown in the sector - and the wider economy.

"The first reading below 50 from the UK’s manufacturing sentiment survey since May 2013 raises fresh concerns over Britain’s economic growth prospects but also those of the world, as this weak number follows equally disappointing readings from China and America," said Russ Mould, investment director at AJ Bell.

Details showed that most of its underlying components, including output, incoming orders, work backlogs and, especially, employment also fell back on the month. On the prices front, deflationary pressures continued to ease in April. Average input costs fell at the slowest pace since June 2015, while the rate of decline in selling prices was only marginal and the weakest in the current eight-month sequence of reduction. Although the EU referendum was mentioned as a negative factor, the downturn appeared to reflect wider vulnerabilities both in the global and domestic economy.

"I would be reluctant in "attributing too much of this [fall to] uncertainty surrounding the EU referendum ... Instead it probably reflects sterling's past appreciation and weak overseas demand to a greater extent." said Capital Economics' Hollingsworth.

It is possible that today’s setback is only a temporary overhang from the sharp intensification of global growth anxieties during the first few weeks of the year. Analysts were divided on what was behind the slip into contraction territory. That said, manufacturing output accounts for only around 10% of UK GDP. The path of growth in Q2 will hinge critically on the services sector which has a nearly 80% share in GDP. UK service sector PMI, which is scheduled for release on Thursday, will provide a much more convincing picture on the near-term outlook.

EUR/GBP was 0.45% higher at 0.7895 at 1100 GMT, while GBP/USD retreated from session highs at 1.4769 to trade at 1.4666 after the data.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate