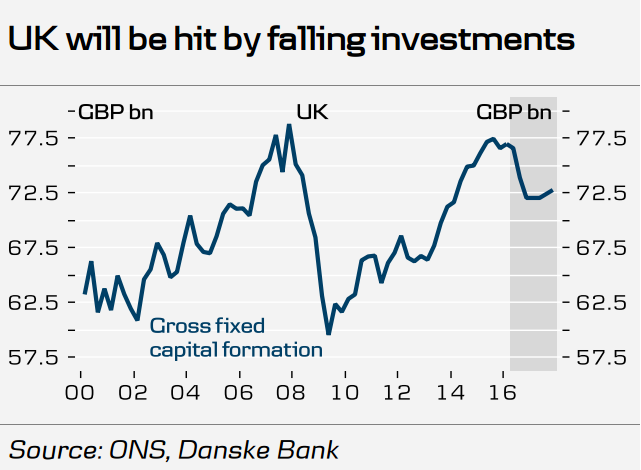

UK outlook following the decision to leave the EU largely depends on how the withdrawal negotiations progress. The longer-run consequences of a Brexit depend on the future UK/EU relationship. Risks of a marked deterioration of external financing conditions seen in light of the U.K.’s extremely elevated level of gross external financing requirements. Expect UK to fall into recession in H2 16 (or early 17) as investments fall due to higher uncertainty about the future economic environment for British firms.

S&P on Monday lowered ratings on United Kingdom by two notches to 'AA' from 'AAA' on Brexit vote, said outlook remains negative on continued uncertainty. The ratings agency said, "The negative outlook reflects the risk to economic prospects, fiscal and external performance, and the role of sterling as a reserve currency, as well as risks to the constitutional and economic integrity of the U.K. if there is another referendum on Scottish independence."

Negotiations are set to begin, with a great deal of uncertainty around what shape the U.K.'s exit will take and when Article 50 of the Lisbon Treaty will be triggered. Lack of clarity on key issues will hurt confidence, investment, GDP growth, and public finances in the U.K., and put at risk important external financing sources vital to the financing of the U.K.’s large current account deficits. Brexit result could lead to a deterioration of the U.K.’s economic performance, including its large financial services sector, which is a major contributor to employment and public receipts. It is also likely that private consumption will slow, especially if the labour market slows down.

"We now expect GDP growth of 1.0% this year and -0.4% next year (previously 1.8% and 2.1%, respectively). We expect low but positive growth again from Q1 17 although the growth outlook depends on how the withdrawal negotiations are progressing (given Article 50 is actually triggered)," said Danske Bank in a report.

UK voters' decision is a game changer for central banks. Both Bank of England and the ECB could ease monetary policy to support the economies. The BoE has communicated it prefers to lower the Bank Rate before using other tools. GBP/USD was trading at 1.3385 at 1215 GMT.

"We expect the BoE to cut the Bank Rate down from 0.50% to 0.00% and to resume the Asset Purchase Facility (APF), which we anticipate will be expanded in the range GBP150-200bn." adds Danske bank.

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out