May 09, 2018 05:54 am UTC| Digital Currency Insights & Views

As you could see, LSKBTC at Binance has tumbled with a steep price slump after breaching below strong support at 0.0013100 levels. Several times in the recent history has shown the strong demand zone at this juncture....

A crisis too big to waste: China's recycling ban calls for a long-term rethink in Australia

May 08, 2018 15:06 pm UTC| Insights & Views

Australias recycling industry is in crisis, with China having effectively closed its borders to foreign recycling. Emergency measures have included stockpiling, landfilling, and trying to find other international...

Australia pitches tax ‘relief’ in election-focused budget

May 08, 2018 15:04 pm UTC| Insights & Views Governance

Treasurer Scott Morrison has unveiled an income tax plan that will cost $140 billion over a decade and initially deliver tax relief up to $530 a year for 4.4 million people earning between $48,000 and $90,000. The...

Private lab tests in Uganda are costly. But price doesn't equal quality

May 08, 2018 15:02 pm UTC| Insights & Views Health

Laboratory tests are the backbone of clinical care. They are used to screen patients, to diagnose diseases and to manage conditions ranging from anaemia and diabetes to HIV and malaria. Considerable effort has gone into...

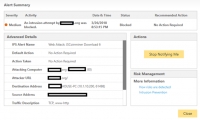

Cryptojacking spreads across the web

May 08, 2018 14:57 pm UTC| Digital Currency Insights & Views

Right now, your computer might be using its memory and processor power and your electricity to generate money for someone else, without you ever knowing. Its called cryptojacking, and it is an offshoot of the rising...

Call Review: Ripple achieves target, XRP/USD makes bearish noise

May 08, 2018 13:29 pm UTC| Research & Analysis Technicals Insights & Views

Weve already highlighted in our recent posts about the bearishness of BTC, ETH and NEM in a close range on Tuesday as these cryptocurrencies continued price dips. BTC is currently trading at around 9327, ETH at 717 and NEM...

Why graduation rates lag for low-income college students

May 08, 2018 12:31 pm UTC| Insights & Views Life

As college students nationwide prepare for graduation, a new analysis has shown that just under half of all those who receive Pell Grants the federal governments main form of direct financial aid for low-income students ...

- Market Data