Here are five signs that universities are turning into corporations

Mar 14, 2018 08:40 am UTC| Insights & Views Business

Universities in many parts of the world are buckling under multiple financial, societal and political demands. This has led to increasingly loud calls for what are called enhanced efficiencies a term drawn from the...

Why do gun-makers get special economic protection?

Mar 14, 2018 08:24 am UTC| Insights & Views Law Economy

The gun industry is one of very few industries to have congressionally backed immunity from liabilty. As a result, its been largely shielded from responsibility for the deaths and injuries its products cause, with few...

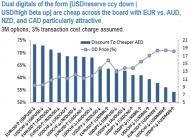

FxWirePro: Dual digitals for Antipodeans on central banks' dovishness in APAC

Mar 14, 2018 08:22 am UTC| Research & Analysis Insights & Views Central Banks

The Aussie remains somewhat pricey compared to short-term fair value estimates, as yield differentials along the curve move steadily in the US dollars favor. This weight on AUD should only increase over the next year or...

Why virtual reality cannot match the real thing

Mar 14, 2018 08:10 am UTC| Insights & Views Technology

Suppose you were offered the opportunity to hook yourself up to a machine that would give you all the experiences you desire. Using this technology you could have the sensations of climbing Mt Everest, enjoying great sex...

We need to become global citizens to rebuild trust in our globalised world

Mar 14, 2018 08:07 am UTC| Insights & Views

This is the third article in a series in which philosophers discuss the greatest moral challenge of our time, and how we should address it. Read the first article here and the second here. The erosion of trust in a...

A timeline of Stephen Hawking's life

Mar 14, 2018 07:57 am UTC| Insights & Views Science

Acclaimed British theoretical physicist, cosmologist and author Stephen Hawking has died aged 76. After being diagnosed at the age of 21, he had lived for more than half a century with motor neurone disease. A family...

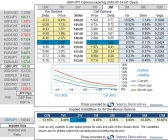

FxWirePro: GBP/JPY OTC bids and FX derivatives hedging strategies ahead of BoE and UK CPI

Mar 14, 2018 07:08 am UTC| Research & Analysis Central Banks Insights & Views

As for monetary policy, we remain to be convinced that a modest increase in UK rates over and above what is now priced (we expect 50bp this year) will be a game-changer for GBP. Growth may have improved in the UK but the...

- Market Data