FxWirePro: Hawks in BoC and NAFTA negotiation to frame CAD outlook upside-down

Jul 19, 2017 11:59 am UTC| Research & Analysis Insights & Views

US-Canada trade relations have entered a rockier patch under the Trump administration with tariffs placed on Canadas softwood lumber industry and threats of further action against other industries. More recently, the US...

Malaysia’s headline inflation moderates in June, no policy change likely from Bank Negara Malaysia

Jul 19, 2017 11:43 am UTC| Insights & Views Central Banks

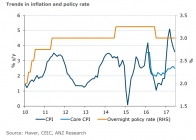

Data released by the federal Department of Statistics on Wednesday showed that Malaysias consumer prices rose at a slower-than-expected pace in June. Seasonally adjusted headline inflation fell 0.2 percent month-over-month...

Where the boundaries lie in workplace relationships

Jul 19, 2017 11:42 am UTC| Insights & Views

In recent weeks two prominent news stories have highlighted workplace romances blowing up into costly public scandals. The romantic relationship between CEO of Seven West Media, Tim Worner, and former executive assistant...

FxWirePro: Are vols cheapening China tail risks on PBoC’s treasury and currency regime?

Jul 19, 2017 11:41 am UTC| Research & Analysis Central Banks Insights & Views

With continued USD weakens, USDCNY dipped to the 6.75 level this morning, i.e. back to the level seen in October. The PBoC set the USDCNY fixing rate at 6.7451, the lowest in nine months. Chinese authorities are again in...

How history can challenge the narrative of blame for homelessness

Jul 19, 2017 11:39 am UTC| Insights & Views Life

Homelessness is a pressing humanitarian problem one that is increasingly in the public eye. The evictions, protests, personal histories and statistical profiles of people experiencing it appear regularly in the...

How we think about our past experiences affects how we can help others

Jul 19, 2017 11:23 am UTC| Insights & Views Life

Have you ever told a friend experiencing a troubling situation I know exactly how you feel? This empathic response is usually driven by a connection weve made with our own similar experiences. Having been there, we...

Inaction on climate change risks leaving future generations $530 trillion in debt

Jul 19, 2017 11:19 am UTC| Insights & Views Economy

By continuing to delay significant reductions in greenhouse gas emissions, we risk handing young people alive today a bill of up to US$535 trillion. This would be the cost of the negative emissions technologies required to...

- Market Data