Jun 16, 2017 12:07 pm UTC| Economy Insights & Views Central Banks

The UK economy has weathered the 12 months since the vote to leave the EU better than feared, though the 1Q gain in GDP was, at 0.1% qoq, the slowest in the EU and the uncertainty emanating from the 8 June election result...

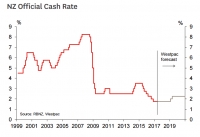

RBNZ expected to remain on hold at 1.75 pct, likely to reaffirm neutral bias

Jun 16, 2017 12:06 pm UTC| Insights & Views Central Banks

The Reserve Bank of New Zealand convenes to decide monetary policy on June 22 and we expect the central bank to stay pat at 1.75 pct. The statement is likely to reaffirm a neutral bias. At an interview following the May...

Jun 16, 2017 10:10 am UTC| Research & Analysis Insights & Views

The full unwind of the post-election Trump trade, which has led to a weaker US dollar and lower US Treasury yields, has supported golds relatively strong performance this year. To reflect a more benign inflation outlook...

It's in the EU’s interest to press ahead with Brexit negotiations

Jun 16, 2017 09:40 am UTC| Insights & Views

The extraordinary outcome of the UK general election and the uncertain domestic political climate has led to calls by Scottish first minister Nicola Sturgeon for a short pause in the Brexit process. Despite this, Brexit...

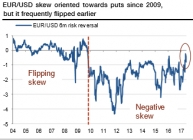

FxWirePro: After monetary policy season, can EUR IV skews could flip for calls?

Jun 16, 2017 07:46 am UTC| Research & Analysis Insights & Views

EURUSD risk reversals (RR), which measure the relative appetite of upside and downside strikes, have been oriented towards puts since end-2009 (refer above graph). However, before 2009, EURUSD RR frequently flipped between...

Jun 16, 2017 06:52 am UTC| Technicals Insights & Views

Gold price behavior has been moving in rising trendline with the triple top formation (refer daily charts). Top 1 at 1263.87, top 2 at 1295.46 and top 3 at 1294.91 levels. Failure swings at stiff resistance have...

Jun 16, 2017 06:32 am UTC| Research & Analysis Insights & Views

Crude oil prices tumbled to their lowest level in a month this week and closed on Thursday at the lowest level since the initial OPEC agreement was reached last November. The catalyst for the collapse is widely viewed as...

- Market Data