How gross inequality and crushed hopes have fed the rise of Donald Trump

Jul 22, 2016 06:17 am UTC| Insights & Views Politics

Donald Trump is now the Republican nominee for president of the United States and millions of people are asking: How could this happen? There is no single answer to this question, but there are some explanations. For...

Is the end of Zika nigh? How populations develop immunity

Jul 22, 2016 06:15 am UTC| Insights & Views Health

The Zika outbreak, arriving on the heels of Ebola and just in time for the Rio Olympics, has challenged global health agencies to respond rapidly and effectively. Determining the appropriate response is far from...

In acceptance speech, Trump embraces role as hero of the forgotten

Jul 22, 2016 06:09 am UTC| Insights & Views Politics

Donald Trump accepted the Republican nomination for the presidency in a speech destined to be remembered by history as the I am your voice speech a phrase that Trump repeated several times to tie together his themes of...

Asia’s 'shoot-to-kill' republic?The rising body count of the Philippines’ 'war on drugs'

Jul 22, 2016 06:05 am UTC| Insights & Views Law

Heres a snapshot of what a coalition of Philippines human rights groups describe as a surge of extrajudicial killings of suspected criminals and drug offenders. 2.50am July 14: Unidentified drug suspect #43 | San Juan...

Jul 21, 2016 12:36 pm UTC| Insights & Views

Q2 was marked by a continued depreciation of the yuan, both against the USD and in trade-weighted terms. But markets have remained calm on the back of lower volatility in the Chinese currency, steady growth (+6.7% GDP...

Jul 21, 2016 11:33 am UTC| Insights & Views

Please be noted that the 1m IVs have been tepid, a tad above 8.5%, skews in these IVs have been puzzling on either side (upper strike 1.4550 and lower strikes at 1.4240 levels. Also, be advised that the narrow range...

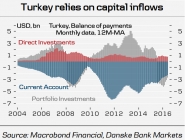

Lingering political uncertainty to weigh on capital inflows into Turkey

Jul 21, 2016 11:01 am UTC| Insights & Views Economy

Turkeys cabinet decided to propose a State of Emergency (SoE) after a recommendation from the State Security Council yesterday. The state of emergency allows President Erdogan to rule by decree for three months, limit...

- Market Data