Three ways to build innovation into your organisation

Apr 14, 2016 07:30 am UTC| Insights & Views Business

Despite the explosive rate of innovation transforming our world, how established organisations innovate themselves is another matter altogether. The string of defunct or struggling organisations such as Kodak, Nokia,...

How to protect nuclear plants from terrorists

Apr 14, 2016 06:55 am UTC| Insights & Views

In the wake of terrorist attacks in Brussels, Paris, Istanbul, Ankara and elsewhere, nations are rethinking many aspects of domestic security. Nuclear plants, as experts have long known, are potential targets for...

Is it too late for Trump and Clinton to become more likable?

Apr 14, 2016 06:50 am UTC| Insights & Views Politics

According to the old adage, one never gets a second chance to make a first impression. Might that hold true for the presidential candidates? There would seem to be plenty of opportunities between now and Election Day ...

Peabody's bankruptcy claim is a symbol of coal's end

Apr 14, 2016 06:47 am UTC| Insights & Views

The announcement that Peabody Energy, the worlds largest non-government coal company, is to file for bankruptcy in the United States is one of more symbolic than substantive significance. In the US context, bankruptcy is a...

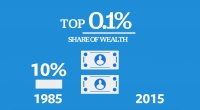

Partisan divide over income inequality makes reducing it even harder

Apr 14, 2016 05:14 am UTC| Insights & Views Politics

A majority of Americans of both parties believe that the gap between rich and poor is getting larger, making the issue a prominent one on the campaign trail this year. But youd be wrong if you thought this meant there...

Inspiring Game of Thrones: Shakespeare's finest female role

Apr 14, 2016 05:05 am UTC| Insights & Views Entertainment

Amid the tidal wave of events marking the 400th anniversary of Shakespeares death in 2016, it is still standout news that Labour party politician Glenda Jackson will be returning to the stage as King Lear, directed by...

Buskers enrich our streets and laws don't have to hinder - they can help

Apr 14, 2016 05:03 am UTC| Insights & Views Law

Street performers have been part of cityscapes for centuries, yet buskers have often had an ambiguous relationship with the law. At various times they have been policed as beggars in disguise, or treated as an urban...

- Market Data