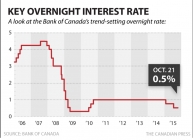

BoC likely to stand pat for the next year regardless of Fed action

Oct 22, 2015 09:31 am UTC| Insights & Views

The Bank of Canada maintained overnight rate at 1/2 percent on Wednesday as widely expected. Even before the landslide sweep of the Liberal Party the Bank was widely expected to stand pat for the foreseeable future. The...

FxWirePro: Improve odds on backspreads - Capitalize on GBP/AUD upswings to employ shorts

Oct 22, 2015 08:46 am UTC| Insights & Views

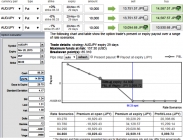

We reckon this pair has shown weakness in recent past, bulls seemed to have been exhausted by giving up the previous rallies even though some left over price bounces can be extended in near term (see technical chart for...

Oct 22, 2015 07:53 am UTC| Insights & Views

The pair has pretty much responded as per earlier analysis, the previous rallies have been paused although we could see a little bit price bounces in near term.As the daily chart suggests some buying interest that would...

FxWirePro: Shorts in AUD/JPY backspread to beat higher IV

Oct 22, 2015 07:19 am UTC| Insights & Views

Traders tend to view the put ratio back spread as a bear strategy, because it employs puts. However, it is actually a volatilitystrategy. The implied volatility of 1M ATM AUDJPY put contract is at 14.09% and it is quite...

FxWirePro: AUD/JPY likely to slide further, next crucial support at 84.576

Oct 22, 2015 06:34 am UTC| Insights & Views

We were bearish on this APAC pair and shared our stance accordingly in our last weeks post, you can now figure out from the daily chart that the yellow circled areas served as the strong demand and supply levels for this...

Oct 21, 2015 12:31 pm UTC| Insights & Views

The gold price is finding it impossible to entirely ignore the weakness among cyclical commodities. There were also some more striking changes: as per the customs authority, exports to China climbed by 28% to a six-month...

BCB likely to stand pat through H1'16, upside risks for inflation outlook persist

Oct 21, 2015 10:53 am UTC| Insights & Views

Brazils October COPOM meeting is expected to be a non-event with markets unanimous in calling for rates to be kept on hold at 14.25% this Wednesday. Brazils macro economic and financial conditions have deteriorated since...

- Market Data