FxWirePro: EUR/CAD bearish sentiments pile up, collars well placed

Aug 27, 2015 09:15 am UTC| Insights & Views

It was exactly a week ago we were confident enough to vouch our write ups No twists in EUR/CADs uptrend - stay firm and safe with option collars. But for now, it is now the time for raising eyebrow and stay with a...

FxWirePro: WTI crude gains as EIA crude inventory shrugs off estimates – not a buy yet

Aug 27, 2015 08:25 am UTC| Insights & Views

As per our forecasts WTI crude oil futures (CL!1) has been extending its loses from last months highs at around 59 levels to 47.44 in first stage and again below 42.22 levels (our 2nd target). Currently, on NYME,WTI crude...

Aug 27, 2015 07:11 am UTC| Insights & Views

As we anticipated earlier that the pair was to experience short term weakness and calendar spread was recommended on 24th August, now look at their effects in weekly and daily charts but probably to show moderate strength...

Aug 27, 2015 06:02 am UTC| Insights & Views

We like to reiterate that it was specified that short term northward direction 14th August and from then steep slumps expected thereafter. It has shown the effects of steep slumps until 72.402 levels, having said that...

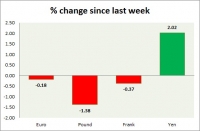

Currency snapshot (major pairs)

Aug 26, 2015 18:09 pm UTC| Insights & Views

Dollar index trading at 94.62 (+1.27%). Strength meter (today so far) - Euro -1.63%, Franc -1.06%, Yen -0.90%, GBP -1.43% Strength meter (since last week) - Euro -0.18%, Franc -0.37%, Yen +2.02%, GBP...

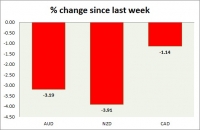

Currency snapshot (commodity pairs)

Aug 26, 2015 17:38 pm UTC| Insights & Views

Dollar index trading at 94.84 (+0.95%) Strength meter (today so far) - Aussie -0.34%, Kiwi -0.77%, Loonie -0.11%. Strength meter (since last week) - Aussie -3.19%, Kiwi -3.91%, Loonie -1.14%. AUD/USD - Trading at...

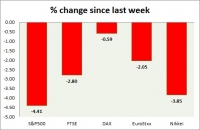

Aug 26, 2015 16:57 pm UTC| Insights & Views

Equities are mixed across globe. Performance this week at a glance in chart table - SP 500 - SP future is down marginally, 0.4% for the day. Todays range 1927-1854. Factory orders rose by 2% in July. SP 500 is...

- Market Data