Mar 06, 2019 11:07 am UTC| Technicals

GBPJPY is trading weak for third consecutive day and lost nearly 200 pips from the high of 148.57 on account of Brexit uncertainty. GBP was trading lower against all major especially with USD and lost more than 250 pips...

FxWirePro: EUR/AUD breaks above daily cloud, hits 8-week highs at 1.6093, bias higher

Mar 06, 2019 10:49 am UTC| Technicals

EUR/AUD chart - Trading View EUR/AUD has shown a breakout at daily daily cloud, intraday bias bullish. AUD weakness across the board after poor GDP data and dovish comments from RBAs Lowe support gains. The...

Mar 06, 2019 10:46 am UTC| Research & Analysis Technicals

WTI crude oils bullishprice sentiments are somewhat exhausted after a strong rise through most of February.As a result, WTI CFDs has spiked about 6.02%. But for now, ahead of the US EIAs inventory reports, WTI crude...

FxWirePro: USDCHF jumps sharply on broad based US dollar buying, jump till 1.010 possible

Mar 06, 2019 10:11 am UTC| Technicals

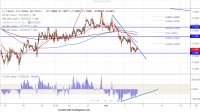

Major Resistance - 1.010 USDCHF has broken major resistance 1.0020 after a long consolidation.The pair was consolidating in narrow range between 1.0020 and 0.9980 for past three trading day.Swiss franc gained...

FxWirePro: EURUSD trades above 1.1300 level, markets eye US ADP data

Mar 06, 2019 09:17 am UTC| Technicals

EURUSD pared minor gains made yesterday after release of better than expected US ISM non manufacturing data.US ISM non manufacturing data came at 59.7 in Feb compared to estimate of 57.3 The pair declined nearly 50 pips...

FxWirePro: EUR/HUF on track to test 200-W SMA, good to stay short on rallies

Mar 06, 2019 09:15 am UTC| Technicals

EUR/HUF chart - Trading View EUR/HUF has broken below 110-W EMA and is now below major EMAs on the weekly chart. Price is extending weakness for the 4th straight week and has slipped below weekly cloud. The...

FxWirePro: Silver moves in stiff boundaries, stay bullish only above $15.15 mark

Mar 06, 2019 08:41 am UTC| Technicals

XAG/USD is currently trading around $15.09 marks. It made intraday high at $15.13 and low at $15.00 levels. Intraday bias remains neutral for the moment. A daily close above $15.11 will test key resistances...

- Market Data