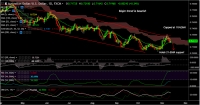

FxWirePro: Buy CHFJPY above 113

Nov 13, 2018 13:47 pm UTC| Technicals

Ichimoku Analysis (Hourly chart) Tenken-Sen - 112.83 Kijun-Sen - 112.72 CHFJPY has halted its weakness around 111.59 and shown a 200 pips jump from that level. It hits high of 113.70 and shown a minor...

Nov 13, 2018 12:45 pm UTC| Technicals

GBPUSD has shown a good bounce of more than 100 pips from low of 1.28270 made yesterday. The jump was mainly due to slight profit booking in USD and mixed UK jobs data. UK economy has added lesser than expected jobs and...

FxWirePro: GBP/USD trades higher after better than expected wage growth, good to buy on dips

Nov 13, 2018 11:55 am UTC| Technicals

GBPUSD has shown a good bounce of more than 100 pips from low of 1.28270 made yesterday. The jump was mainly due to slight profit booking in USD and mixed UK jobs data. UK economy has added lesser than expected jobs and...

FxWirePro: Lingering optimism for ripple (XRP), both fundamentally and technically

Nov 13, 2018 11:27 am UTC| Research & Analysis Technicals Insights & Views

As Ripples ecosystem has been emerging and so is the demand,XRPUSDprice seems to be attempting to transform bullish cyphers quite often, the price eased to an intraday high of $0.53429 levels at Bitfinex, following a...

Nov 13, 2018 10:13 am UTC| Technicals Research & Analysis

AUD/USD chart on Trading View used for analysis FxWirePro Currency Strength Index for AUD/USD: Bias Bearish FxWirePros Hourly AUD Spot Index was at -102.263 (Bearish) FxWirePros Hourly USD Spot Index was at 119.602...

FxWirePro: EUR/USD shows dead cat bounce on US-China trade talks optimism, good to sell on rallies

Nov 13, 2018 09:58 am UTC| Technicals

EURUSD has shown a dead cat bounce after hitting 17-month low on account of easing trade tensions between US and China. The Italy budget deficit problem is major issue that putting pressure on Euro. European Commission has...

FxWirePro: USD/JPY stalls downside, retakes 114 handle, renewed US-China trade optimism supports

Nov 13, 2018 09:23 am UTC| Technicals Research & Analysis

USD/JPY chart on Trading View used for analysis USD/JPY erases early dip to 113.58 levels, retakes 114 handle, intraday bias higher. Comments from Chinas premier Li renewed hopes for improvement in US-China...

- Market Data