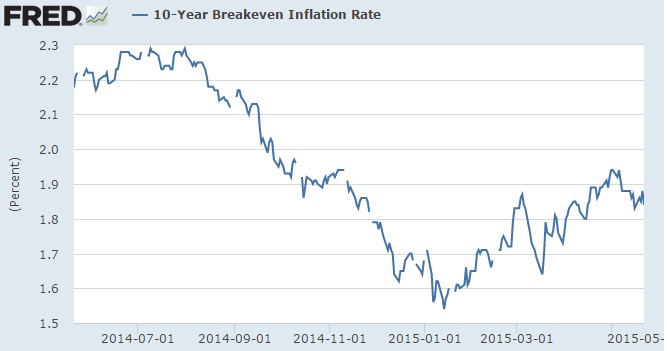

While FED is sure to reach the inflation target of 2% in the medium term (which means 5-6 years), market based measure of inflation expectation is faltering. 10 year breakeven inflation rate demanded by market participants remain well anchored below 2% target.

- Last time, 10 year breakeven inflation rate as measured from treasury inflation protected securities (TIPS) reached almost 2.5%, when US Federal Reserve decided to move ahead with a rate hike.

However that does not ensure FED will wait this time too for such levels, before raising interest rate first time since 2006.

- Last time hike came from much elevated levels. Federal funds rate was at 1% level compared to current 0-0.25% range.

Some members of the FOMC might still be calling for further wait and watch and inflation to reach beyond 2%, however from June expect hawks to outnumber doves in FOMC.

According to hawks, Economy and inflation is strong enough to handle first rate hike of 25 basis points.

Dollar and interest rates might adjust fast, as rate hike might come before market expectation of a much later date.

Dollar index is currently trading at 96.38, up 0.27% today.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?