Among entire commodity space, the prices have been pressurized and continued to drop in last month (21st Dec. - 20th Jan.), especially the slumping crude oil prices has been the center of attention. While the energy index plunged and the industrial metals index also dropped sharply, elsewhere prices were comparatively stable, with the precious metals index even up a little.

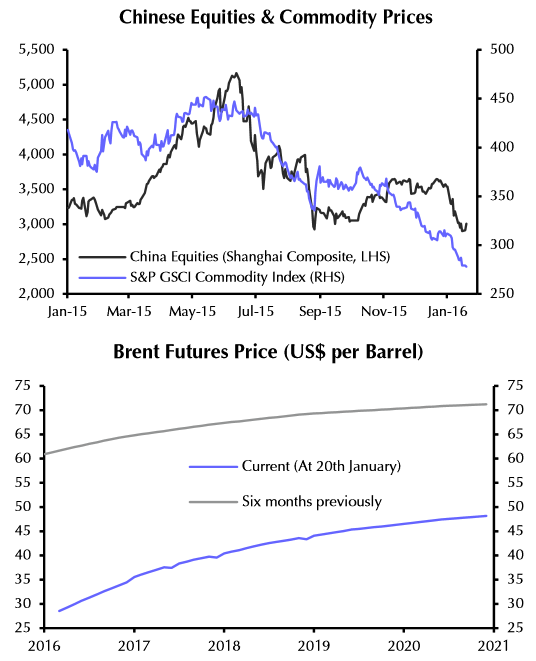

Consistent slump in crude prices are reflected in the under performance of the energy-heavy GSCI index compared to equities over the past month.

While the Bloomberg Commodities Index (which has a lower weighting for energy commodities) held up better. The most significant drivers of the slump in prices over the past month have been threats from Chinese slowdown in demand also reflected in the breakdown in Chinese equities since the turn of the year.

In addition to that, renewed concerns over excess supply in the inventories still lingering. Indeed, the importance of these factors is underlined by the fact that the commodity price falls of the past month came despite a period of relative stability for the US dollar.

Meanwhile, open interest in WTI jumped by 9%, despite the plunge in prices. Energy commodity markets remain in steep slump as high stocks keep spot prices under severe pressure.

No disparity between spot and futures market: Brent futures prices have slid in sync with the recent dips in spot prices. The entire Brent futures curve out to 2020 is now below $50 per barrel. Even though US natural gas futures have declined at the short end of the curve, expectations for prices this time next year have risen compared to a month ago.

A glimpse on crude oil fundamentals, no disparity between Brent spot and futures

Monday, January 25, 2016 12:09 PM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate