ADP employment data to be released at 13:15 GMT is today's most vital dockets from US to be watched by market participants. This is part of the key data ahead of December FOMC,

What is ADP employment?

- The report is a measure of non-farm private sector employment which is obtained by utilizing an anonymous subset of roughly 400,000 U.S. businesses which are clients of ADP.

- This data is a very good measure of employment strength of the economy and a good precursor of Nonfarm payroll data.

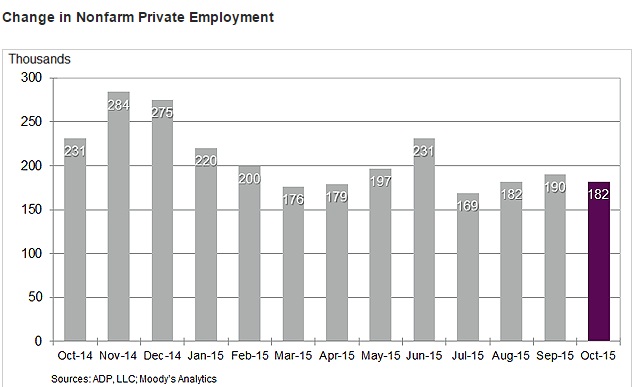

Previous performance

- Non-farm private sector employment grew at 182,000 in October. In September payroll grew by 200,000.

- Small business sector hiring at 90,000.

- Employment in franchise increased by 52,500.

- 2,000 jobs were lost in manufacturing sector.

- 24,000 jobs were added in goods producing sector.

- Construction sector added 35,000 on payroll.

- 9,000 jobs were added in financial activities.

- Services sector is main job provider. Payroll added 158,000 people in September.

Expectation Today

- Headline number is expected to rise to 190,000 as per median estimate.

Market Impact

- Any gain above 200,000 will be considered to be very good and Dollar might gain momentum. However large sustained push unlikely ahead of ECB tomorrow.

- Data below 160,000 likely to give rise to concerns regarding US economic prowess and might lead to risk aversion as well as slide in Dollar.

- Though unlikely, but any number below 130,000 will lead to some serious confusion how FED might be reading this.

- All in all, this is a vital piece of docket after yesterday's disappointing ISM.

FXCM US Dollar index is currently trading at 12160.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022