Crude oil (WTI) is finding support around $43/barrel critical support area, ahead of FOMC tomorrow, making it a make or break event for WTI.

Today bulls are coy in charge, however likely to exercise caution ahead of EIA weekly report.

Key factors at play in Crude market -

- Crude oil production in US has dropped but remains above 9 million barrels/day.

- OPEC production is well above 30 million barrels/day quota, highest since 2008. However OPEC members lack further spare capacity to push production higher, without significant investments.

- Goldman Sachs has recently cut its forecast for WTI to $38/barrel in next one month.

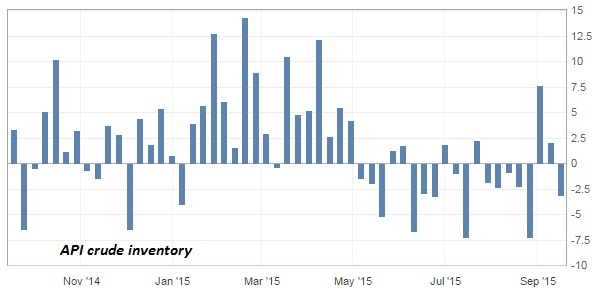

- American Petroleum Institute's (API) weekly report showed inventory deficit of 3.1 million barrels, which is second consecutive weekly rise.

Today's report might work as key catalyst for crude oil market, setting the mood ahead of FOMC

Today's inventory report from US Energy Information Administration (EIA), to be released at 14:30 GMT.

Trade idea -

- Crude is trapped under the force of both Bulls and Bears. While Bulls are trying to push prices close to our previous target of $53/barrel. Bears are looking to break to 2008/09 crisis low around $35/barrel.

- $43/barrel are remains key, which bulls have not given up on yet. Today's EIA report and tomorrow's FOMC holds key to further moves.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand