Crude oil is finding some bids around $40/barrel, might be on the process of forming a key interim bottom. WTI is currently trading at $42.7/barrel, up from its recent low around $39.5/barrel.

Key factors at play in Crude market -

- Crude oil production in US remains above 9.5 million barrels/day, in spite of sharp drop in production.

- OPEC production is well above 30 million barrels/day quota, highest since 2008.

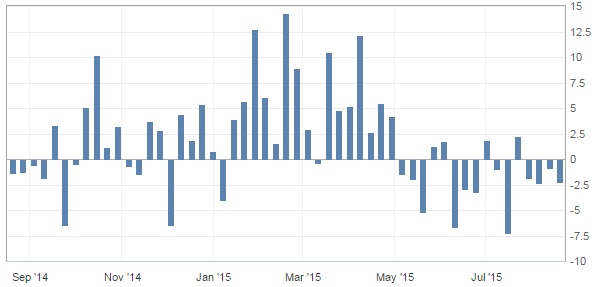

- American Petroleum Institute's (API) weekly report showed inventory depletion by 2.3 million barrels, which is fourth consecutive weekly drop.

Today's report might work as key catalyst for crude oil market, though it is unlikely to reverse the large bearish trend.

Today's inventory report from US Energy Information Administration (EIA), to be released at 14:30 GMT. Expectation is for 0.8 million drop in inventory.

Active Trade idea -

- Crude oil has reached all our down side targets of $55, $51, $46, $42/barrel, and traded below $40/barrel. Extreme sentiment is suggesting that there could be interim reversal.

- Crude has declined for nine consecutive week already, longest in more than three decades at least.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings