Crude oil (WTI) is finding some bids around $44/barrel area just above $43.3/barrel critical support area, is moving sharply higher ahead of key inventory report release from Energy information administration (EIA). WTI is currently trading at $45.9/barrel.

However, bulls are likely to exercise caution after yesterday's 7.7% slump in price.

Key factors at play in Crude market

- Crude oil production in US has dropped recently but remains well above 9 million barrels/day.

- OPEC production is well above 30 million barrels/day quota, highest since 2008. However OPEC members lack further spare capacity to push production higher, without significant investments.

- Iran has additional capacity and might boost production if sanctions removed.

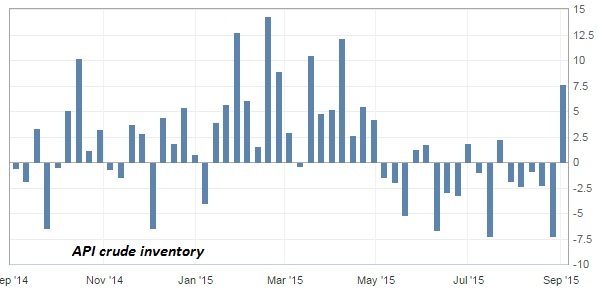

- American Petroleum Institute's (API) weekly report showed inventory surplus of 7.6 million barrels, which is fourth consecutive weekly drop.

Today's report might work as key catalyst for crude oil market, as volatility is very high.

Today's inventory report from US Energy Information Administration (EIA), to be released at 14:30 GMT.

Active Trade idea

- We expect WTI to trade as high as $53/barrel as long as support around $39/barrel holds.

- Key support stands at $43.3/ barrel and $41.5/barrel.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings