WTI edged lower as Saudi oil minister Ali al-Naimi waters production cut hopes.

Key factors at play in Crude market

- Venezuela's efforts and upbeat mood after recent production freeze announcement got watered down by Saudi Arabia's oil mister, speaking at Houston as he indicated Saudi Arabia won't cut production as others can't be trusted to deliver similar cuts.

- Nevertheless Venezuela led OPEC would try to freeze global production at least.

- US lawmakers passed bill to lift 40 year oil ban on US crude export this year and US crude has left for Europe. Supply is expected to rise 4.1 million barrels/day over the next five years.

- Latest IEA report shows, supply glut likely to persist through 2017 and shocks may only come at the end of decade.

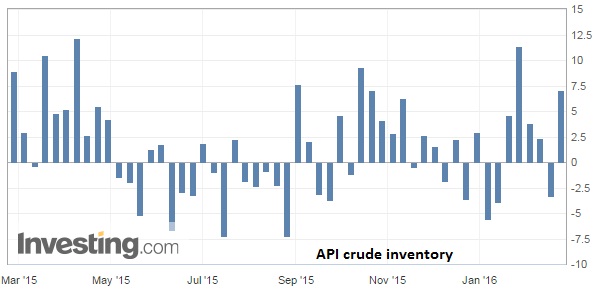

- American Petroleum Institute's (API) weekly report showed inventory rose sharply by 7.1 million barrels.

- Oil price is down, however lack of investments in the sector make prices vulnerable to supply shocks in future. IEA report confirmed this view

Today's inventory report from US Energy Information Administration (EIA), to be released at 16:00 GMT.

Chart courtesy investing.com

Trade idea

- We at FxWirePro remains committed to downside, price action suggests further drop in prices. Goldman Sachs has called for $20/barrel oil, while Standard Charted called for $10/barrel and EIA, $5/barrel.

- According to our calculations, next targets for oil are $22 and $20.3/barrel.

- WTI-Brent spread could widen over lower demand of US crude. It is currently at $1.7/barrel.

- Our ultra-short term call for Crude to recover to $41/barrel seems to be have gotten watered down by Mr. Naimi. Revising stop loss from $26 to $29.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX