Highlighted events today:

- Public Sector Net Borrowing: The British public finances showed a deficit of £6.74 billion in March of 2015, from a revised shortfall of £4.8 billion in February of 2015 reported by the Office for National Statistics.

- BoE's governor Carney speech

- MPC Member Shafik Speech

Bulls, avoid Call Ratio Spread with ATM options

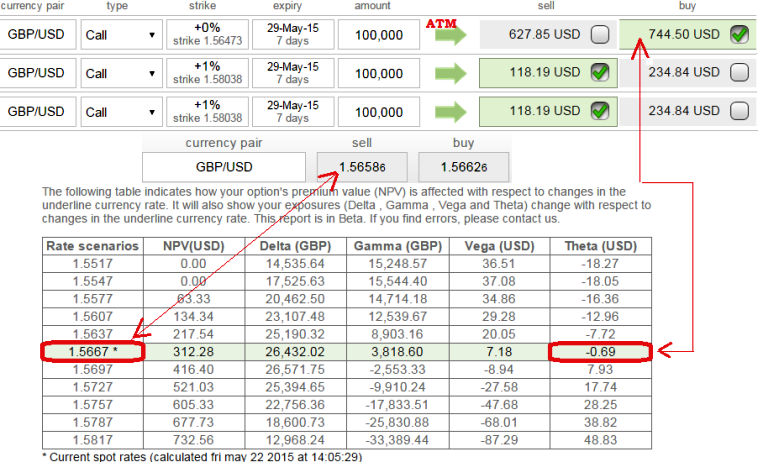

Let's shed some light here on this strategy, how the positions should be constructed with ATM calls is the real challenge as Theta indicates time decay in option premium as they seem overpriced.

Usually long ATM call and short more OTM calls at a higher strike price in ratio of 1:2 or 1:3 would build the position. But are the ATM calls in this case rightly priced in..? Alternatively look in for slightly higher strikes (then it would become marginally OTM).

As usual short time frame to expiration is preferred to take advantage of time decay in short positions and not to give stock time to move higher. Margin is required to take short call positions.

The reason why we are advising call ratio spread over bull call spread is that we believe the prevailing macro economic and political news are already priced in, the additional bull rallies are just a premium and for trading speculating purpose, however there is no room for downside risk as well.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings