The AUD/JPY showed a minor profit booking after the RBA Assistant Governor Sarah Hunter. It reached an intraday low of 97.90 and is currently trading around 97.95. The intraday trend remains bullish as long as support at 97 holds.

Speaking at the 2025 AFIA Conference in Sydney on September 15, RBA Assistant Governor Sarah Hunter emphasized that Australia is approaching its 2-3% inflation objective. With basic inflation approaching the middle point. Hunter said that the economy for the country was balanced, noting consumer spending resilience in spite of elevated interest rates while admitting dangers on both sides. In difficult local and worldwide conditions, she underlined the discussions of the RBA. Her comments, made together with other well-known speakers, including Assistant Treasurer Dr. Daniel Mulino, emphasized her key contribution in developing the RBA's monetary and economic policies.

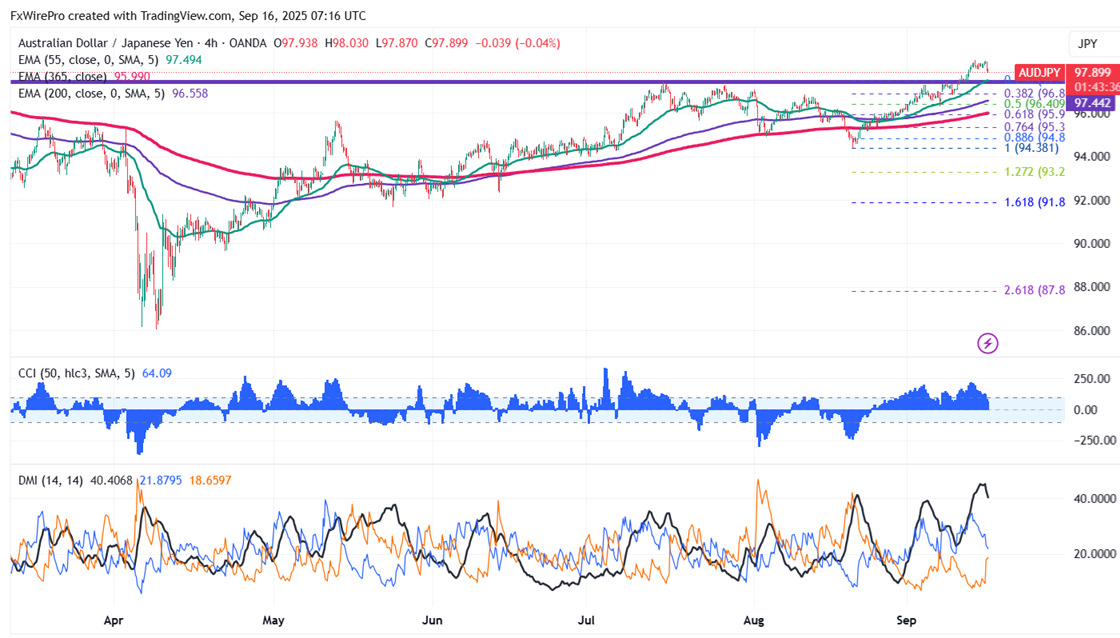

The pair is trading above 55 and 200 EMA and 365 EMA (long-term) on the 4-hour chart, confirming a bullish trend. Any violation below 97.48 indicates the intraday trend is weak. A dip to 97/96.75/96.30/96/ 95.50/95/94.40/93.95/93 is possible. Immediate resistance is at 98.50, a breach above this level targets 98.75/100/100.42.

Market Indicators (4-hour chart)

CCI (50)- Bullish

Directional movement index - Neutral

Trading Strategy: Buy

It is good to buy on dips around 97.65-70 with SL around 97 for a TP of 100