AUD/USD has continued its trend weakening over the past month, hitting a new six-year low of 0.7216 following China's currency move. The continued weakening in global commodity prices has also impacted on AUD sentiment. The knock-on consequences of slower global commodity demand and the surprise decision of China to devalue the yuan underscore the challenges facing the Australian economy. At its latest policy meeting, the RBA left interest rates unchanged and dropped its previous reference to further currency depreciation. Nevertheless, monetary policy remains extremely loose.

The market is pricing in slightly less than a 50% probability of another cut in interest rates over the coming months, although this would almost certainly rise if global demand conditions continue to weaken.

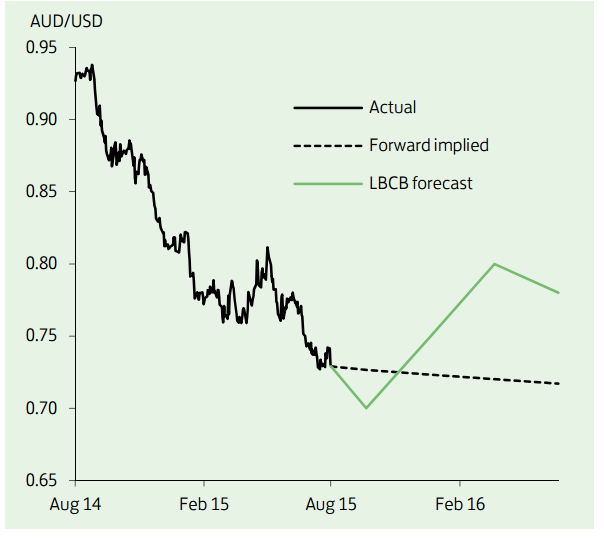

"Given the soft backdrop and the prospect of a rise in US interest rates next month, we look for AUD/USD to test key support down around 0.70-0.69 around the September Fed meeting. If, as we expect, this support holds and commodity prices start to recover, AUD/USD should move higher into year end," notes Lloyds Bank.

AUD/USD Outlook

Wednesday, August 12, 2015 9:56 PM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022