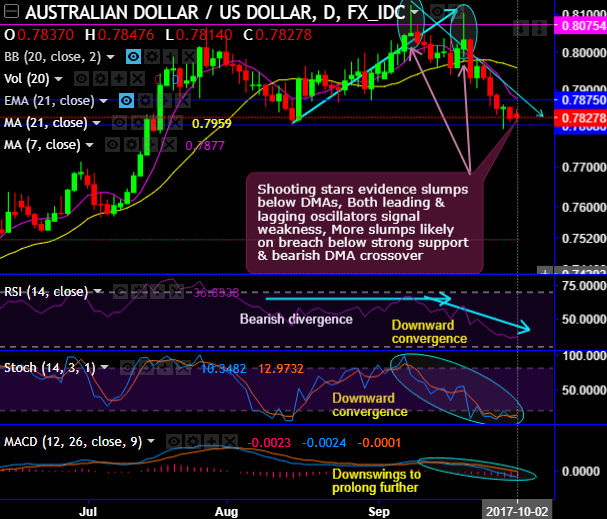

Shooting star pattern candles have occurred at 0.8051 and again at 0.8033 levels on AUDUSD peaks of rallies. Consequently, bears have managed to show their effects by evidencing price dips (refer daily chart).

The stiff resistance level was observed at 0.8075 – 0.8125 range that was rejected, while the strong support is seen at 0.7875 – 0.78 levels which has now been broken downside.

For now, we foresee more slumps as it slid below DMAs and 7DMA crosses below 21DMA which is a bearish crossover.

Despite the hammer pattern candle has occurred, bears shrug off to head southwards breaking above stated strong support at 0.7575, now more slumps on cards upon indications from both leading and lagging oscillators. Break below 0.78 would be even more clarity for the resumption of the major downtrend.

Thereby, the short-term trend seems weaker upon above mentioned shooting stars formation which was stated in our previous write up, while bearish RSI divergence was also traced out in that write up in conjunction with stochastic and MACD’s substantiation for the prevailing weakness.

On a broader perspective, it was also stated in our previous post that the major trend breaching long lasting range in the consolidation phase (refer monthly chart), but for now, we get a little scepticism on further rallies as we trace out shooting star formation in last month’s candle (refer monthly charts), the major trend is bearish biased.

No doubt, the range resistance was broken in the major trend but it couldn’t sustain above (refer monthly chart). As a result, the major trend is back in range.

Both leading oscillators (RSI & stochastic) on this timeframe, indicate overbought pressures, while lagging oscillators (both MAs & MACD) signal consolidation phase to prolong further.

Hence, contemplating above technical rationale, at spot reference: 0.7812, upon breach below 0.78 the intraday speculators can easily eye on minimum southward targets upto 0.7780 levels, thus, snap rallies and deploy one touch binary puts.

Currency Strength Index: FxWirePro's hourly AUD spot index has shown -21 (which is mildly bearish), while hourly USD spot index was at 70 (bullish) at 06:34 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit: