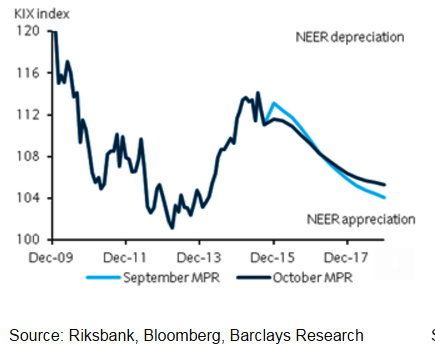

The Riksbank remains concerned about an abrupt SEK appreciation and is pencilling a softer pace of SEK effective exchange rate appreciation over the forecast horizon. A prolonged period of SEK strength remains a key concern for the Riksbank, which remains uncomfortable with the way it has traded recently.

With the inflation recovery still at a fragile stage, a modest verbal intervention by Riksbank officials, highlighting the need for a weaker SEK. With this in mind and due to the downward revisions to inflation and the repo rate path, the Riksbank now expects a somewhat slower pace of currency appreciation over the forecast horizon.

Indeed, the Riksbank has clearly targeted a weaker SEK since Q1 2015, partly helping in easing monetary conditions, which are close to levels last seen during the GFC. However, strong Swedish fundamentals have helped unwind losses following prior easing.

"The valuation models continue to suggest material SEK undervaluation, and we continue to think that the Riksbank will be more comfortable in allowing currency appreciation once the inflation trajectory is firmly on track", says Barclays.

Abrupt SEK appreciation remains a concern for Riksbank

Thursday, October 29, 2015 3:15 AM UTC

Editor's Picks

- Market Data

Most Popular

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady