The Monetary Authority of Singapore in a somewhat unexpected move today lowered the SGD NEER slope by 0.5% to 1% from the previous market assumption of 1.5%. The much-smaller-than-expected move suggests that the MAS appears to be more relaxed over the growth path than the market believes. MAS has also repeatedly shown that it is capable of catching the market by surprise.

All other policy parameters of the SGD NEER were maintained. The MAS also left its inflation assumptions intact. The Authority narrowed its estimate for headline and core inflation to -0.5% - consistent with its earlier forecast ranges. Analysts believe the smaller-than-expected slope adjustment was a token signal, as there was no material change to the Authority's assessment of growth and CPI inflation.

Although the statement's tone was more dovish, the MAS retained its growth forecast for the year at around 2-2.5%, with risks tilted to the downside. It noted that the outlook for the economy is subdued but is not a cause for panic. The advanced estimate of Q3 GDP, released along with the policy statement, showed an annualised q/q increase of 0.1%, which means the economy avoided a technical recession, but by the narrowest of margins.

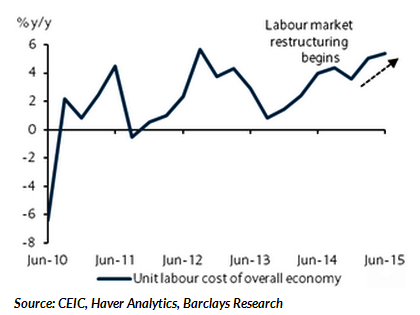

In today's statement, the MAS noted that wage cost pressure remains, a step down from underlying cost pressures in the economy. This was one notable change in the MAS assessment of wage costs and is a clear indication that the MAS believes the labour market remains tight, but to a slightly lesser extent than before.

Overall, today's token easing was consistent with the analysts' view of no material deterioration in the outlook for growth and inflation amid the still-tight labour market. More importantly, it does not signal to us that additional policy easing in April 2016 is likely, unless there is a significant worsening in the external outlook or signs of a clear and systemic external shock.

"Current valuations do not reflect a slope reduction, positioning skewed towards receivers. As such today's slope reduction, ceteris paribus, further erodes the embedded FX carry in the SGD rates, and should result in a 50bp upward re-pricing of short-end SGD rates versus the basket yield", says Barclays in a note to its clients.

The fact that the MAS did not loosen its strings as much as expected was a disappointment for the markets. The Singapore dollar rose as a result, up 0.67%, extended gains to 1.3904/USD after MAS decision. The SGD NEER strengthened 50bp, an unusual reaction to a proper easing move. USD/SGD was trading at 1.3861 at 1011 GMT.

"We believe the broader USD/SGD trend is intact. Although this key idiosyncratic SGD risk event is out of the way, we see several external catalysts to drive USD/SGD higher", adds Barclays.

Additional policy easing from Monetary Authority of Singapore unlikely in April 2016

Wednesday, October 14, 2015 11:07 AM UTC

Editor's Picks

- Market Data

Most Popular

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.