Chinese humanoid robot maker AgiBot is preparing for a major initial public offering (IPO) in Hong Kong next year, targeting a valuation between HK$40 billion and HK$50 billion (approximately $5.14–$6.4 billion), according to insider sources. The Shanghai-based startup, founded in 2023 by ex-Huawei engineers Deng Taihua and Peng Zhihui, has quickly risen to prominence amid China’s push to expand its robotics and automation capabilities.

AgiBot has appointed China International Capital Corp (CICC) and CITIC Securities as lead underwriters, with Morgan Stanley joining the effort recently. The firm aims to file a preliminary prospectus early next year and potentially list publicly by the third quarter of 2026, sources said. The IPO could involve the issuance of 15%–25% of its shares, though final details are still subject to change. As of March, PitchBook valued the company at $2.07 billion.

The company’s rapid growth has been fueled by strong investor backing, including Tencent, HongShan Capital Group (HSG), LG Electronics, Mirae Asset, BYD, and Hillhouse Investment. In August, AgiBot secured a multi-million yuan partnership with Fulin Precision Engineering, deploying nearly 100 of its Yuanzheng humanoid robots in factory operations.

AgiBot develops humanoid robots and AI-powered data collection tools under its Yuanzheng and Lingxi product lines, focusing on applications in manufacturing, logistics, and service automation. At its Shanghai training center, robots are trained for complex daily tasks like folding clothes, making coffee, and cleaning.

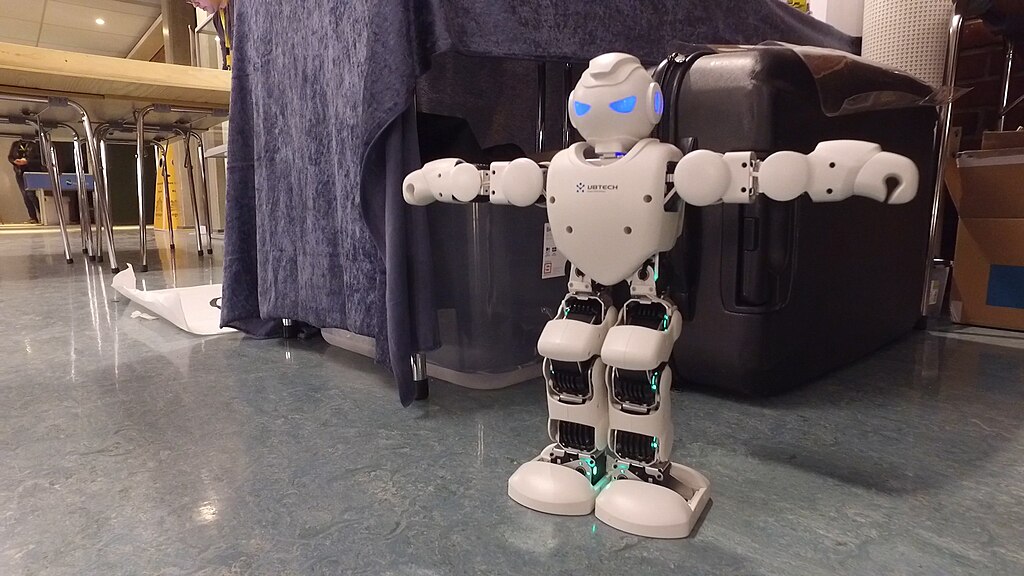

The company gained significant attention earlier this year when President Xi Jinping visited its facilities, showcasing the government’s support for the domestic robotics industry. Its upcoming IPO follows Ubtech Robotics’ 2023 Hong Kong debut, whose stock has surged over 150% this year, and comes as Unitree Robotics plans its own IPO on Shanghai’s STAR Market at a potential 50 billion yuan valuation.

With over 270 IPO filings in Hong Kong this year, the city has reclaimed its status as the world’s leading exchange by combined IPO and secondary listings, raising nearly $24 billion—more than double the total funds raised in 2024.

AgiBot’s planned public offering signals China’s growing ambition to lead the global humanoid robotics race, backed by strong capital, advanced AI integration, and government endorsement.

Trump Media Weighs Truth Social Spin-Off Amid $6B Fusion Energy Pivot

Trump Media Weighs Truth Social Spin-Off Amid $6B Fusion Energy Pivot  Samsung and SK Hynix Shares Hit Record Highs as Nvidia Earnings Boost AI Chip Demand

Samsung and SK Hynix Shares Hit Record Highs as Nvidia Earnings Boost AI Chip Demand  Trump Orders Federal Agencies to Halt Use of Anthropic AI Technology

Trump Orders Federal Agencies to Halt Use of Anthropic AI Technology  Meta Encryption Plan Sparks Child Safety Concerns Amid New Mexico Lawsuit

Meta Encryption Plan Sparks Child Safety Concerns Amid New Mexico Lawsuit  Panama Investigates CK Hutchison’s Port Unit After Court Voids Canal Contracts

Panama Investigates CK Hutchison’s Port Unit After Court Voids Canal Contracts  OpenAI Faces Scrutiny After Banning ChatGPT Account of Tumbler Ridge Shooting Suspect

OpenAI Faces Scrutiny After Banning ChatGPT Account of Tumbler Ridge Shooting Suspect  AWS Data Center in UAE Hit by Fire After Objects Strike Facility Amid Regional Tensions

AWS Data Center in UAE Hit by Fire After Objects Strike Facility Amid Regional Tensions  Samsung Electronics Stock Poised for $1 Trillion Valuation Amid AI and Memory Boom

Samsung Electronics Stock Poised for $1 Trillion Valuation Amid AI and Memory Boom  Australia Targets AI Platforms With Strict Age Verification Rules

Australia Targets AI Platforms With Strict Age Verification Rules  Trump Pushes Tech Giants to Build Power Plants to Offset AI Data Center Energy Costs

Trump Pushes Tech Giants to Build Power Plants to Offset AI Data Center Energy Costs  Netflix Declines to Raise Bid for Warner Bros. Discovery Amid Competing Paramount Skydance Offer

Netflix Declines to Raise Bid for Warner Bros. Discovery Amid Competing Paramount Skydance Offer  Nvidia Earnings Preview: AI Growth Outlook Remains Strong Beyond 2026

Nvidia Earnings Preview: AI Growth Outlook Remains Strong Beyond 2026  Qantas Shares Plunge 10% as Iran Strikes Send Oil Prices Soaring and Disrupt Global Flights

Qantas Shares Plunge 10% as Iran Strikes Send Oil Prices Soaring and Disrupt Global Flights  Nvidia Earnings Preview: AI Chip Demand, Data Center Growth and Blackwell Shipments in Focus

Nvidia Earnings Preview: AI Chip Demand, Data Center Growth and Blackwell Shipments in Focus  Hyundai Motor Group to Invest $6.26 Billion in AI Data Center, Robotics and Renewable Energy Projects in South Korea

Hyundai Motor Group to Invest $6.26 Billion in AI Data Center, Robotics and Renewable Energy Projects in South Korea  xAI’s Grok Secures Pentagon Deal for Classified Military AI Systems Amid Anthropic Dispute

xAI’s Grok Secures Pentagon Deal for Classified Military AI Systems Amid Anthropic Dispute