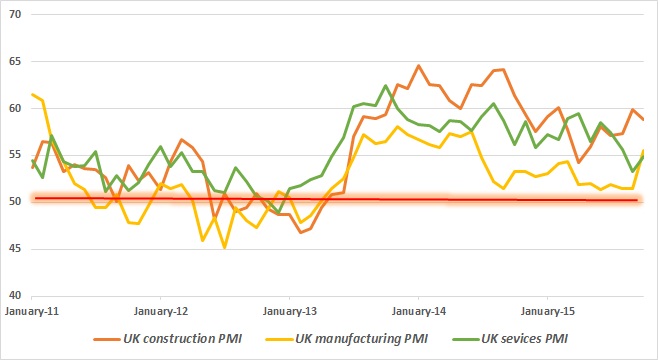

Last three days of PMI report from Markit economics have shown that UK economy is quite robust heading into final quarter of the year.

- Monday's manufacturing PMI showed, strong rebound in manufacturing sector. PMI surprised to the upside to 55.5 compared to 51.7 in September and 51.3 expected. Growth in new orders have been encouraging. Report provided evidence that in spite of weakness from abroad, domestic economy has fastened. Manufacturing sector contributes 14% to GDP.

- Tuesday's construction PMI was way above 50 mark, (above which signals expansion) at 58.8. Though headline PMI slowed down from September's 59.9, growth was broad based. All three components, residential, commercial and civil engineering business activity grew with commercial leading the way. Moreover job creation in the sector has hit 11 month high. Construction sector contributes 6% to GDP.

- Today's services PMI painted similar robust picture. Growth rate in services sector has strengthened for first time in four months and headline PMI moving to 54.9 in October from 53.3 in September. Employment has started growing again at fast pace, fastest since May. Services sector contributes 79% to GDP.

As of now, fourth quarter seem to have started on a positive note for UK economy, however deflationary threat is still at large. BRC shop prices dropped for 30th consecutive month, declining by -1.8% in October.

Pound however failed to gain much from improvement dockets as Bank of England policy meeting scheduled tomorrow, followed by NFP report from US on Friday. Pound is currently trading at 1.542 against Dollar.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand