Marvell Technology (NASDAQ: MRVL) shares surged 3.1% in after-hours trading to $122.92, following a 2.4% gain during Thursday’s session, as Amazon (NASDAQ: AMZN) reaffirmed its commitment to AI infrastructure spending.

Despite Amazon reporting weaker-than-expected Q4 earnings for its Amazon Web Services (AWS) unit, the tech giant reiterated plans to invest billions in AI chips, networking, and data center expansion. CFO Brian Olsavsky stated that capital expenditures could exceed $100 billion in 2025, primarily for AWS growth and AI services.

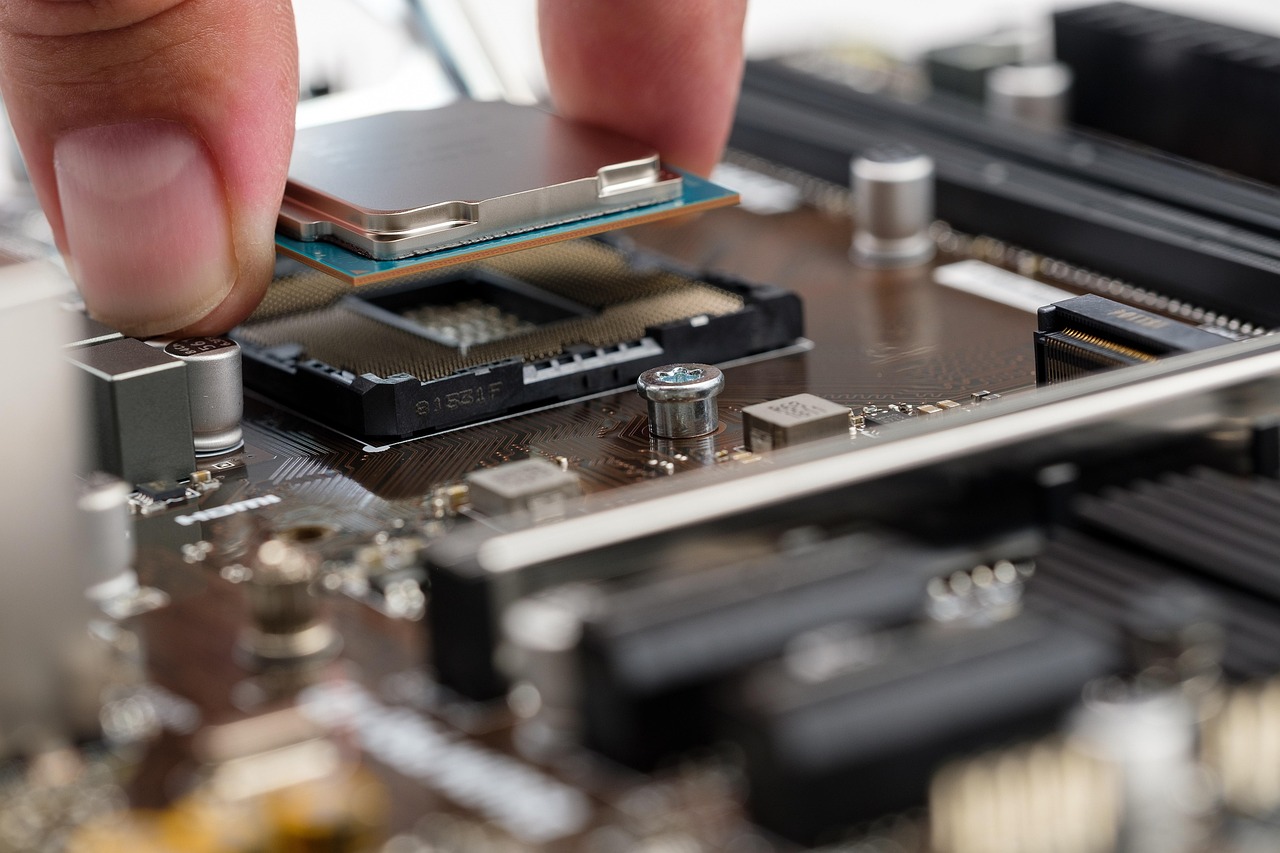

Amazon and Marvell established a five-year agreement in late 2024, with Marvell supplying custom chips and data center equipment, including contributions to AWS’s Trainium 2 AI chip. Amazon has been ramping up efforts to compete with AI powerhouse NVIDIA (NASDAQ: NVDA) through proprietary chip development and server solutions.

Marvell, a key supplier to OEMs and ODMs, has capitalized on surging AI chip demand, especially for data centers. With its stock doubling in 2024, the company is positioned for continued growth as AI adoption accelerates.

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies

Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit

Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit  Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns

Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns  Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns