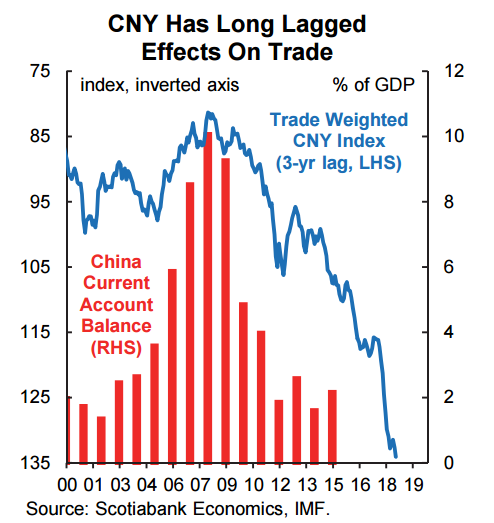

The print for September arrives early in the week and consensus thinks that yes, indeed, they are still falling at about a 6% y/y pace. The outlook for China's current account balance and the narrower trade account balance may remain bearish for some time. Notwithstanding the devaluation in August, China's currency is still lofty and will probably carry further negative effects on trade competitiveness for a while yet. A combination of an unwillingness to import tighter US monetary policy through the yuan-dollar peg, growth worries, and financial reforms are likely to lead to further currency devaluations.

While the pace of decline in China's reserves from about US$4 trillion over a year ago to US$3.5 trillion last month may slow compared to the steep drop in August when the central bank sold USD to buy yuan and set a floor following devaluation, China is at risk of eating up more of its reserves for a long time yet. In some sense this is part of the required global rebalancing argument toward redeploying stockpiled, hoarded savings but the pace at which this adjustment occurs will create ongoing volatility.

Are Chinese exports still falling at a relatively rapid year-ago clip?

Thursday, October 8, 2015 8:58 PM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX