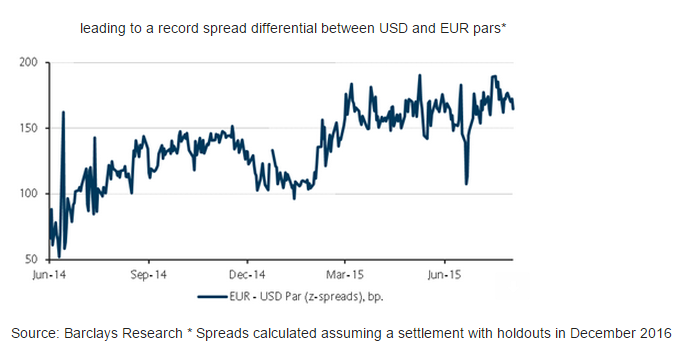

The price differential between USD and EUR pars has widened from 2pts in January to 7pts at present, likely driven by the pricing in of an acceleration premium into USD pars. Little justification is seen for this premium, as there is a low likelihood that NY pars will obtain pari passu treatment and that acceleration could translate into an "enhancement" for USD pars. The premium seems particularly puzzling relative to EUR pars, as a scenario of unequal outcomes for USD and EUR pars seems remote.

"Taking into account the increasing differential between USD and EUR rates, exacerbating the gap in Z-spreads between the two securities (calculated based on our future cash flow assumptions), we think USD pars are c.10 points/150bp too expensive relative to EUR pars. We recommend selling USD pars and buying EUR pars," notes Barclays.

There are necessary and sufficient conditions to be met if pars acceleration is to result in any financial benefit. The necessary condition is a settlement with pari passu holdouts. This would mean that the new administration is committed to re-engaging with markets. The sufficient condition is that the authorities have no alternative but to capitulate to the financial demands of holders of accelerated par bonds. If these two conditions hold, pars holders might have the leverage required to "waive acceleration" in exchange for an 'enhancement' on their pars bonds. The enhancement could come in the form of an increase in the coupon or a side payment.

If the new authorities were to engage in settlement negotiations with 1994 FAA bondholders, as part of these negotiations, pari passu holdouts would ask the district court to lift the injunction preventing intermediaries from processing exchange bond payments. Exchange bonds (including pars) require (on a series-by-series basis) a 25% threshold to accelerate the series and at least 50% to waive default; more than one-third is required to prevent a majority from amending non-reserved matters. Hence, to unlock past due interest (and, potentially, interest on interest) on exchange bonds and to make pars current again, at least 50% of exchange bond holders would need to waive default. But at least 50% of a certain series of pars could reject granting the acceleration waiver.

The district court has yet to rule on whether a UK law issued under the same Trust Indenture can get a pari passu injunction. It is thus far from established in court that EUR pars will not get a pari passu injunction if NY pars succeed. EUR pars are governed by UK law, so they would need to get a judgement for their accelerated claim in the UK. EUR pars were issued under the same indenture, so pari passu provision language reads the same as in NY pars, potentially expediting the process.

The holders' concentration of old EUR par is high. The Euro Bondholder Group (EBG) holds about 20% ($1.4bn) of the old Euro Par series and claims to hold about 40% of the euro-denominated exchange bonds (Euro old Pars, Euro new Pars, Euro old Discounts and Euro new Discounts), according to court documents. A higher concentration means a higher likelihood that EUR bonds will be paid PDI at the moment of a settlement with holdouts and, on the other hand, could facilitate acceleration, a default waiver, or participation in a restructuring effort. The EBG constructive position, as documented in an August 5 2014 "non-acceleration letter" addressed to BNY, would support this view.

In a post-holdout settlement context, Argentina could swap EUR pars for USD pars. This would increase Argentina's weight in the indices, and would be NPV neutral for the sovereign and positive for EUR exchange bonds. The arbitrage possibility should tend to equalize "exit spreads" between USD and EUR pars once Argentina normalizes its relationship with markets.

Differences in trading liquidity are also too marginal to warrant a significant premium in USD pars vs EUR pars, the current 7pt premium in USD pars cash prices over EUR pars makes them c.10 points (or c.150bp in spread terms) too expensive on a relative basis. The lower cash price and hence more attractive convexity features of EUR pars should add to the attractiveness of switching from USD pars into EUR pars.

Argentina’s par bonds: Unjustified acceleration premium; switch into EUR from USD pars

Thursday, August 6, 2015 11:46 PM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX