Arctos Partners has chosen to invest in Aston Martin’s Formula One team ahead of F1’s anticipated return to Las Vegas. This deal places a valuation of approximately £1 billion on the racing unit.

It also marked the first instance where team owner Lawrence Stroll has sought external investors for the F1 team he is associated with, according to the Financial Times.

Arctos Joins Holding Company of Aston Martin's F1 Team: AMR Holdings GP Limited

Reuters reported that this significant investment by Arctos entails the acquisition of a "minority shareholding" in AMR Holdings GP Limited, the holding company of Aston Martin's F1 team. While specific financial details were not disclosed, confidential sources suggest a £1 billion valuation for the team.

Arctos stands alongside Saudi Aramco as a partner of the team, while not holding a stake in the business. However, the state oil group assumes the option to purchase 10% of the unit in the future. Lawrence Stroll expressed his satisfaction with Arctos' involvement, highlighting their valuable industry insights. The Aston Martin team is now proud to join Arctos' esteemed portfolio of investments.

Arctos boasts an extensive sports portfolio, including ownership stakes in various sports such as football, basketball, and baseball. Notably, they hold a minority stake in Fenway Sports Group, the parent company of Liverpool Football Club and the Red Sox baseball team, solidifying their presence in the sports industry.

Arctos plans to provide substantial resources to enhance the team's brand and extend its reach, drawing from their extensive experience in sports management.

F1 Team Valuations Continue to Rise

The valuation of F1 teams has seen significant growth since Lawrence Stroll's acquisition of the team, originally known as Force India, before rebranding as Racing Point and ultimately becoming Aston Martin in 2021. In June, Renault's Alpine outfit achieved a valuation of approximately $900mn, following investments from RedBird Capital Partners, Otro Capital, and Hollywood actor Ryan Reynolds, resulting in a 24% stake.

Sir Jim Ratcliffe’s Ineos acquired a one-third stake in the Mercedes F1 team, totaling £208 million in January 2022. Dorilton, a US-based investment group, completed the acquisition of the Williams team for €152mn in August 2020. Additionally, McLaren sold a stake worth £560 million to MSP Sports Capital and other investors in December of the same year.

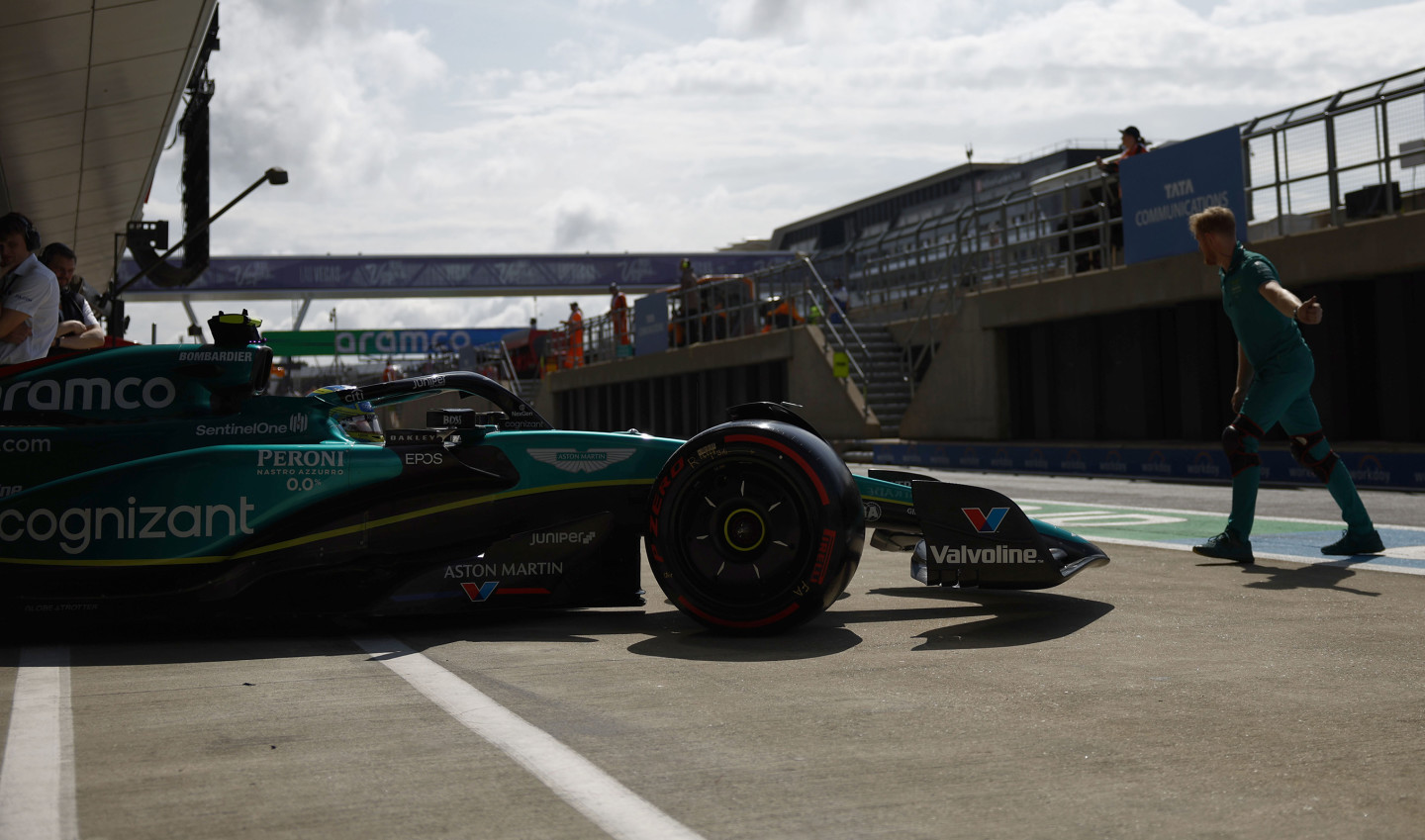

Photo: Aston Martin F1 Newsroom

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  How did sport become so popular? The ancient history of a modern obsession

How did sport become so popular? The ancient history of a modern obsession  Washington Post Publisher Will Lewis Steps Down After Layoffs

Washington Post Publisher Will Lewis Steps Down After Layoffs  SoftBank Eyes Up to $25B OpenAI Investment Amid AI Boom

SoftBank Eyes Up to $25B OpenAI Investment Amid AI Boom  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Gold Prices Rise as Markets Await Trump’s Policy Announcements

Gold Prices Rise as Markets Await Trump’s Policy Announcements  Hims & Hers Halts Compounded Semaglutide Pill After FDA Warning

Hims & Hers Halts Compounded Semaglutide Pill After FDA Warning  Trump Draws Cheers at Ryder Cup as U.S. Trails Europe After Opening Day

Trump Draws Cheers at Ryder Cup as U.S. Trails Europe After Opening Day  JD Vance to Lead U.S. Presidential Delegation at Milano Cortina Winter Olympics Opening Ceremony

JD Vance to Lead U.S. Presidential Delegation at Milano Cortina Winter Olympics Opening Ceremony  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  Trump Threatens Stadium Deal Over Washington Commanders Name

Trump Threatens Stadium Deal Over Washington Commanders Name  Bitcoin Hits $100K Milestone Amid Optimism Over Trump Policies

Bitcoin Hits $100K Milestone Amid Optimism Over Trump Policies  Trump Set to Announce Washington D.C. as Host of 2027 NFL Draft

Trump Set to Announce Washington D.C. as Host of 2027 NFL Draft  KiwiSaver shakeup: private asset investment has risks that could outweigh the rewards

KiwiSaver shakeup: private asset investment has risks that could outweigh the rewards  U.S. Stock Futures Rise as Trump Takes Office, Corporate Earnings Awaited

U.S. Stock Futures Rise as Trump Takes Office, Corporate Earnings Awaited  Trump Urges Hall of Fame Induction for Roger Clemens Amid Renewed Debate

Trump Urges Hall of Fame Induction for Roger Clemens Amid Renewed Debate