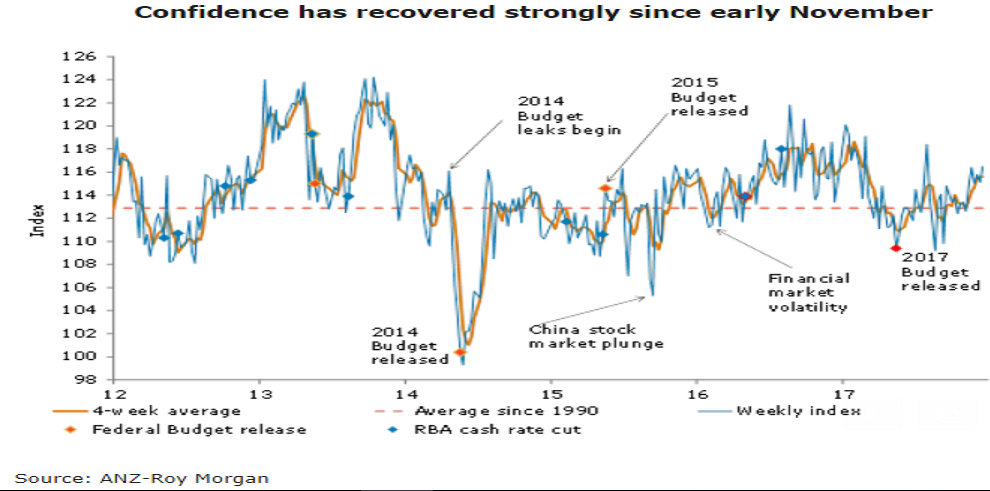

Australia’s ANZ-Roy Morgan Australian Consumer Confidence ended the year at 116.5 with a 1.2 percent bounce last week. The details were positive, with all sub-indices except ‘time to buy a household item’ posting gains.

Sentiment towards both current and future economic conditions rose for the third straight week (2.4 percent and 1.1 percent respectively). This and other gains are indicative of the sustained turnaround in overall sentiment since the low for the year in August.

Views towards current financial conditions jumped a solid 3.6 percent last week, more than offsetting the 2.7 percent fall previously. Views towards future financial conditions improved 0.5 percent last week, following a 2.8 percent fall in the previous week. Both sub-indices currently sit above their long term averages.

Sentiment around the ‘time to buy a household item’ fell 1.2 percent last week. Inflation expectations remained stable at 4.5 percent in four-week moving average terms.

"Even as views towards economic conditions have bounced, confidence in financial conditions, particularly in the near term, has faltered. This reflects a number of headwinds consumers have faced in 2017, particularly persistently weak wage growth and high household debt. As such, we believe that a pick in wage growth is the key to a further improvement in confidence over 2018," said David Plank, Head of Australian Economics, ANZ Research.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election